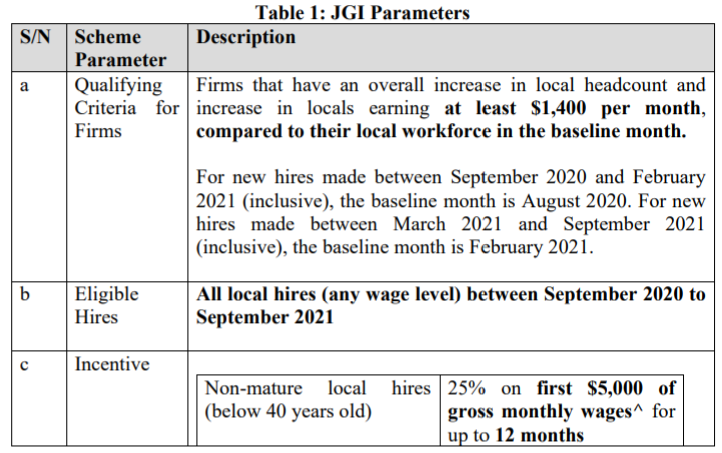

Food and

Beverage | Entities must be classified under SSICs 56, or 68104. Licensees registered as

individuals will also be included if they make mandatory CPF contributions for their employees. | 10% | 50% |

Performing Arts &

Arts Education | Entities must:

• Meet at least one of the conditions of being a: (i) participant in a project, activity, programme or festival supported by the National Arts Council (NAC) or National Heritage Board (NHB) between 1 April 2018 to 31 March 2021; or (ii) Museum Roundtable member before 31 March 2021; or (iii) accredited Arts Education Programme (AEP) provider listed in the 2019-2022 NAC-AEP Directory; or (iv) has more than two-thirds of its business in arts/heritage related activities (as defined by one of the 6 qualifying SSICs in criterion 2); and

• Be classified under SSICs 85420, 90001, 90002, 90003, 90004 or 90009. | 10% | 50% |

| Sports | Gyms, fitness studios and other sports facilities that must:

• Be classified under SSIC 93111, 93119, 93120 or 85410; and

• Operate sports- and/or fitness-related programmes that are (i) conducted indoors

without masks on prior to P2(HA); or (ii) for those 18 years and under prior to

P2(HA). | 0% | 50% |

|

| Retail | Qualifying retail outlets must:

• Have physical storefronts; and

• Be classified under SSICs 47191, 47199, 474, 475, 476, 4771, 47721, 4773,

4774, 47752, 47759, 47761, 47769, 4777, 47802, or 4799. | 10% | 30% |

| Cinema operators | Entities must:

• Hold a valid Film Exhibition licence from the Infocomm Media Development Authority (IMDA); and

• Be classified under SSIC 5914. | 10% | 30% |

Museums, art

galleries and

historical sites | Entities must:

• Meet at least one of the conditions of being a: (i) participant in a project, activity, programme or festival supported by the National Arts Council (NAC) or National Heritage Board (NHB) between 1 April 2018 to 31 March 2021; (ii) Museum Roundtable member before 31 March 2021; or (iii) accredited Arts Education Programme (AEP) provider listed in the 2019-2022 NAC-AEP Directory; or (iv) has more than two-thirds of its business in arts/heritage related activities (as defined by one of the 6 qualifying SSICs in criterion 2); and

• Be classified under SSICs 91021, 91022, 91029 | 10% | 30% |

Indoor

playgrounds and

other family

entertainment

centres | Entities must:

• Be classified under SSICs 93201 or 93209; and

• Operate family entertainment centres or family attractions-related businesses. | 0% | 30% |

Indoor

playgrounds and

other family

entertainment

centres | Entities must:

• Be classified under SSICs 93201 or 93209; and

• Operate family entertainment centres or family attractions-related businesses. | 0% | 30% |

Affected Personal

Care Services

| Entities must:

• Be classified under SSIC 96022 or 96029;

• Have physical storefronts; and

• Operate personal care services that require masks to be removed (e.g. facial and

spa)

| 0% | 30% |