Companies in Singapore may be wound up, struck off, or restructured depending on their financial situation. Whether your company is dormant, solvent, insolvent, or under creditor pressure, it’s important to understand the appropriate exit or rescue options under Singapore law.

This guide outlines five main options to legally close, restructure, or resolve your company’s affairs:

Strike-Off

Liquidation

Simplified Insolvency Programme (SIP)

Judicial Management (JM)

Receivership

Strike-Off (Deregistration)

Best for: Dormant companies with no assets or liabilities.

Strike-off is a voluntary process where a company applies to ACRA to be removed from the register.

Eligibility Conditions:

No business activity or assets.

No outstanding liabilities to IRAS, CPF, ACRA, or others.

No existing charges or ongoing legal proceedings.

Written consent of all directors.

Process:

Finalise tax clearance with IRAS.

Apply via BizFile+ to ACRA.

ACRA issues a notice in the Gazette (30 days for objections).

If no objections, company is struck off ~4 months from submission.

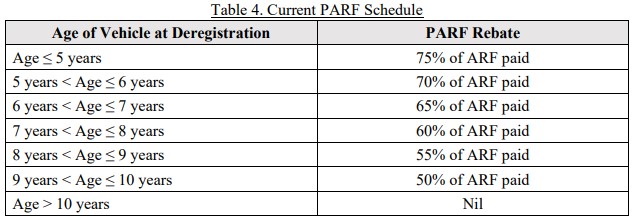

Cost Estimate:

ACRA fee: Free

Professional services: S$800 – S$2,000

Voluntary or Compulsory Liquidation

Best for: Companies with assets and liabilities.

There are 2 types:

Members’ Voluntary Liquidation (MVL) – company is solvent.

Creditors’ Voluntary Liquidation (CVL) – company is insolvent and initiated by directors.

Compulsory Liquidation – ordered by the Court upon creditor’s petition.

Steps (MVL):

Declare solvency and pass resolution.

Appoint licensed liquidator.

Realise assets, pay creditors, distribute surplus to shareholders.

Liquidator files final returns and company is dissolved.

Cost Estimate:

MVL: S$8,000 – S$20,000+

CVL/Compulsory: May exceed S$30,000 depending on complexity.

Simplified Insolvency Programme (SIP)

Best for: Small, insolvent companies with simple affairs.

Introduced during COVID-19, SIP is a fast-track version of liquidation or debt restructuring for qualifying companies.

Eligibility:

Annual revenue ≤ S$10 million

Liabilities ≤ S$2 million

Fewer than 30 creditors

Two streams:

Simplified Winding-Up Programme (SWUP) – lower-cost version of CVL.

Simplified Debt Restructuring Programme (SDRP) – similar to scheme of arrangement but streamlined.

Cost Estimate:

S$3,000 – S$8,000

Judicial Management (JM)

Best for: Companies with potential to be saved or restructured.

JM is a court-supervised process where a judicial manager is appointed to take control and attempt to rehabilitate the company.

Who can apply:

The company

Its creditors

Its liquidator (if applicable)

Benefits:

Automatic moratorium (legal protection from creditors)

Breathing room to restructure debt or find a buyer

Judicial manager can terminate unprofitable contracts

Outcome:

Company may recover, be sold, or proceed to liquidation if turnaround fails.

Cost Estimate:

S$20,000 – S$100,000+ (depends on duration and complexity)

Receivership

Best for: Secured creditors enforcing security.

Receivership occurs when a creditor (usually a bank) appoints a receiver to seize and realise specific assets under a debenture.

Scope:

Receiver manages only secured assets (e.g., land, receivables).

Directors may retain control over the rest of the company.

Common Scenarios:

Default on a loan secured by company assets.

Receiver sells business as a going concern or liquidates assets.

Outcome:

Often leads to liquidation after enforcement is complete.

Cost Estimate:

Depends on value and nature of assets; borne by proceeds of realisation.

Summary of Closure & Insolvency Options

Conclusion

Singapore provides multiple legal avenues to close or restructure a company, tailored to its financial position and future prospects. Whether your company is dormant, struggling, or facing creditor pressure, understanding the available options—from strike-off to judicial management—can help you exit responsibly, protect stakeholders, and avoid future penalties.

Need help choosing the right path? Our team of company secretaries and insolvency professionals can assist with compliance, closure strategy, and stakeholder communication.