Jobs and Business Support Package

Jobs Growth Incentive

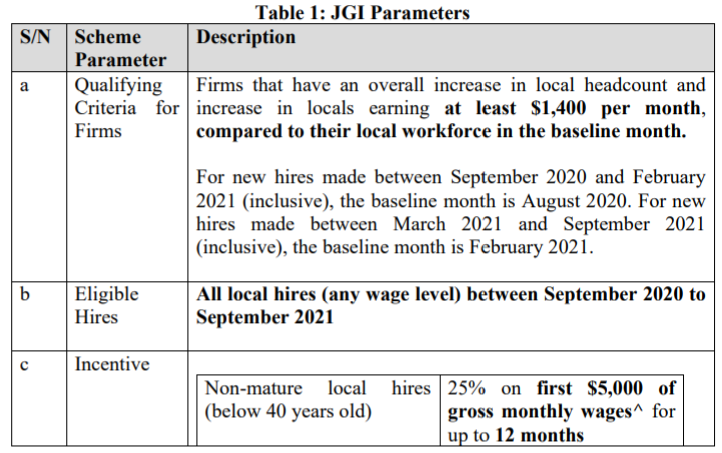

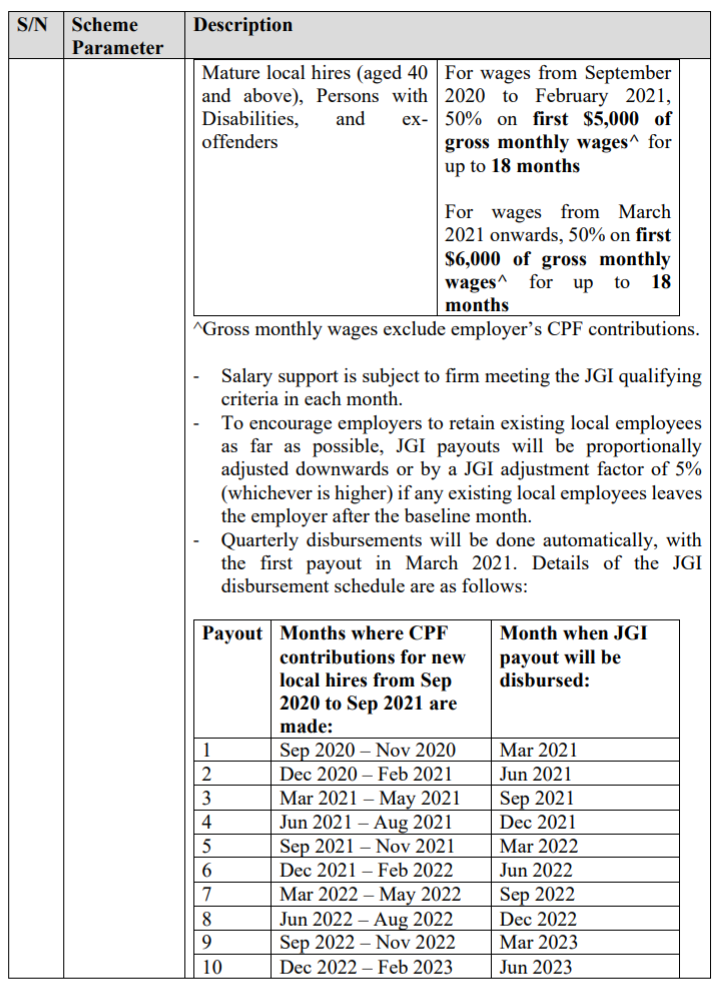

Jobs Growth Incentive provides salary support for employers to expand local hiring from September 2020 to March 2022 (inclusive). Jobs Growth Incentive has been extended by six months to September 2022, with stepped-down rates reflecting the improved labour market conditions. This extension will only cover mature workers aged 40 and above who have not been employed for six months or more, persons with disabilities, and ex-offenders.

Employers that increase their overall local workforce between September 2020 and September 2022 (inclusive) will receive Government support as follows:

- Phase 1 of the JGI: September 2020 to February 2021

- For non-mature local worker – Up to 25% of first $5,000 for 12 months

- For mature, PwD or ex-offender local hires – For gross monthly wages paid in Sep 2020 – Feb 2021, up to 50% of first $5,000

- For mature, PwD or ex-offender local hires – For gross monthly wages paid from Mar 2021 onwards, up to 50% of first $6,000 for 18 months

- Phase 2 of the JGI: March 2021 to September 2021

- For non-mature local worker – Up to 25% of first $5,000 for 12 months

- For mature, PwD or ex-offender local hires – Up to 50% of first $6,000 for 18 months

- Phase 3 of the JGI: October 2021 to March 2022

- For non-mature local worker – Up to 15% of first $5,000 for 6 months

- For mature, PwD or ex-offender local hires – Up to 50% of first $6,000 for 12 months

- Phase 4 of the JGI: April 2022 to September 2022

- For mature, PwD or ex-offender local hires – Details to be announced.

Employers do NOT need to apply for the JGI. IRAS will notify eligible employers by post of the amount of JGI payout payable to them. They can also log in to myTax Portal to view the electronic copy of their letter.

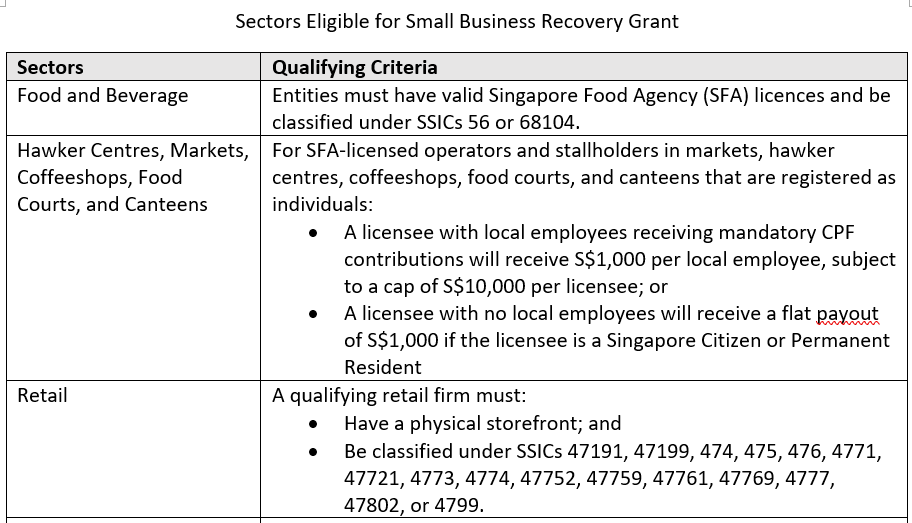

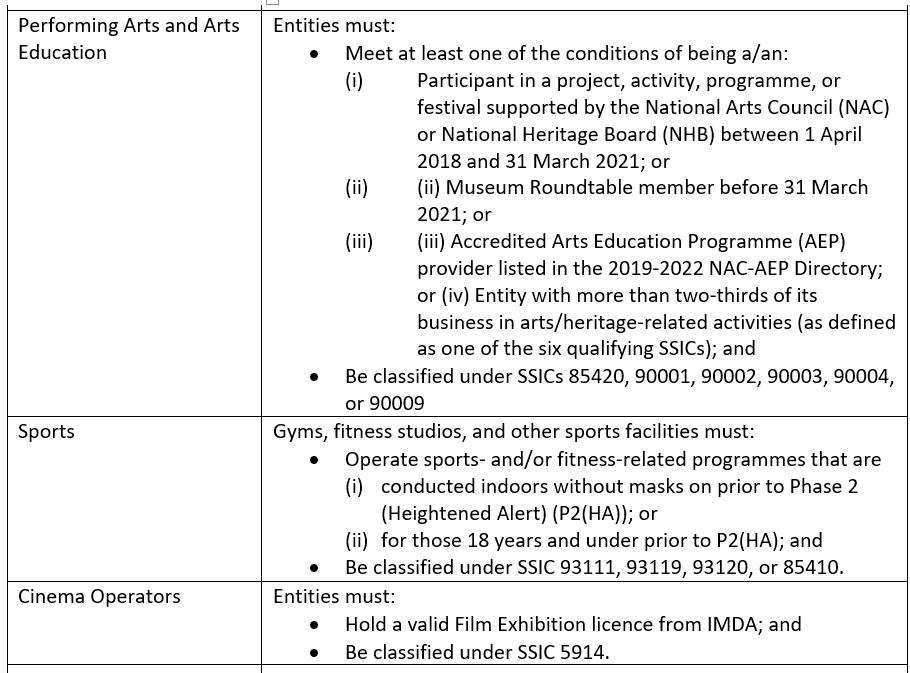

Small Business Recover Grant

Small Business Recover Grant provides a one-off cash support to small business in sectors that were most affected by Covid-19 Safe Management Measures last year.

Eligibility:

Business is physically present in Singapore and registered no later than 31 December 2021.

Annual operating revenue is less than S$100 million, filed with IRAS in the YA 21 by 31 December 2021; or employ fewer than 200 employees as of 31 December 2021.

Eligible firm will receive:

$1,000 payout per local employee with mandatory CPF contribution. (Capped at S$10,000 per firm);or

$1,000 payout to local sole proprietors and partnerships without hire any local employees and earning a net trade income of no more than S$100,000.

Employers do NOT need to apply. IRAS will notify eligible firms starting from June 2022.

Enhanced Financing Support

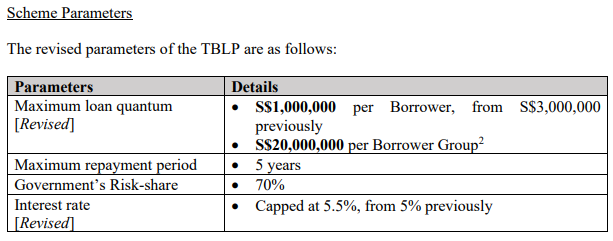

Temporary Bridging Loan Programme (TBLP)

The Temporary Bridging Loan Programme (TBLP) provide enterprises with access to working capital during the COVID-19 crisis. The TBLP will be extended for another six months to 30 September 2022, with revised parameters, in view of the continued impact of COVID-19 and recent increase in business costs.

Eligibility:

- Be a business entity that is registered and physically present in Singapore

- At least 30% local equity held directly or indirectly by Singaporean(s) and/or Singapore PR(s), determined by the ultimate individual ownership

Application:

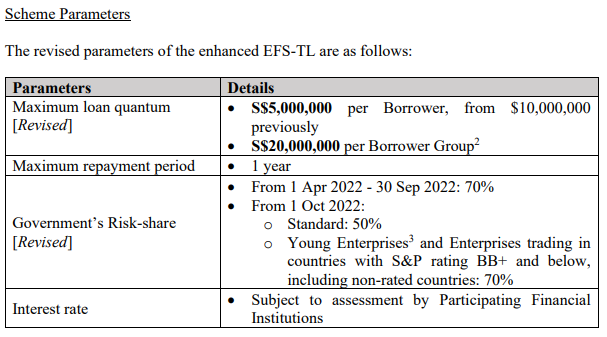

Enterprise Financing Scheme – Trade Loan (EFS-TL)

The Enterprise Financing Scheme – Trade Loan (EFS-TL) supports Singapore-based enterprises’ trade financing needs, which include the financing of short-term import, export, and guarantee needs. The enhancement to EFS-TL will be extended for a further six months to 30 September 2022, with revised parameters given continued uncertainties in the global trade ecosystem.

Finance trade needs, including:

- Inventory / stock financing

- Structured pre-delivery working capital (revolving working capital)

- Factoring (with recourse) / bill of invoice / AR discounting

- Overseas working capital loan

- Bank Guarantee (capped at 2 years tenure)

Eligibility:

- Be a business entity that is registered and physically present in Singapore, and

- At least 30% local equity held directly or indirectly by Singaporean(s) and/or Singapore PR(s), determined by the ultimate individual ownership, and

- Have Group Annual Sales Turnover of not more than S$500 million

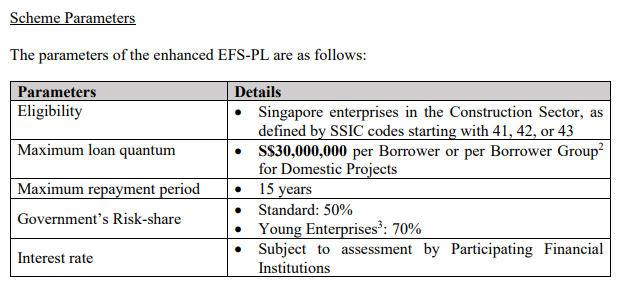

Enterprise Financing Scheme – Project Loan (EFS-PL)

The Enterprise Financing Scheme – Project Loan (EFS-PL) supports Singapore-based enterprises’ overseas project financing needs, which include the financing of working capital, guarantee, and fixed assets. The enhancement to EFS-PL will be extended for another year to 31 March 2023, to support

construction enterprises in fulfilling domestic projects amidst rising costs and tightened cashflow.

Finance the fulfillment of secured overseas projects. The supportable loan types include:

- Working Capital Loan

- Factory/ Building/ Land (includes Purchase/ Renovation/ Construction)

- Equipment/ Machineries/ Vessels/ Other Fixed Assets/ Machinery Hire Purchase

- Guarantees

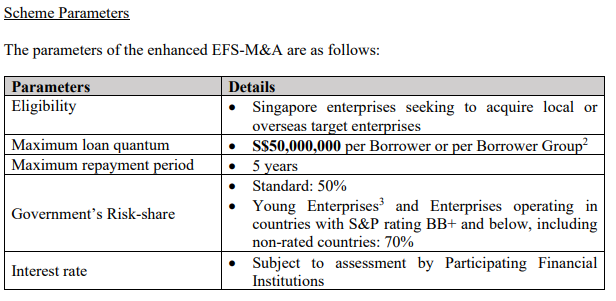

Enterprise Financing Scheme – Merger and Acquisition Loan (EFS-M&A)

The Enterprise Financing Scheme – Merger and Acquisition Loan (EFS-M&A) supports Singapore-based enterprises’ acquisition of overseas or local enterprises, with the intent of internationalisation. The EFS-M&A will be enhanced for four years, from 1 April 2022 to 31 March 2026, to include domestic M&A activities. This is to support enterprises to scale and expand through M&A, including venturing into complementary businesses and emerging sectors.

Investing in Digital Capabilities

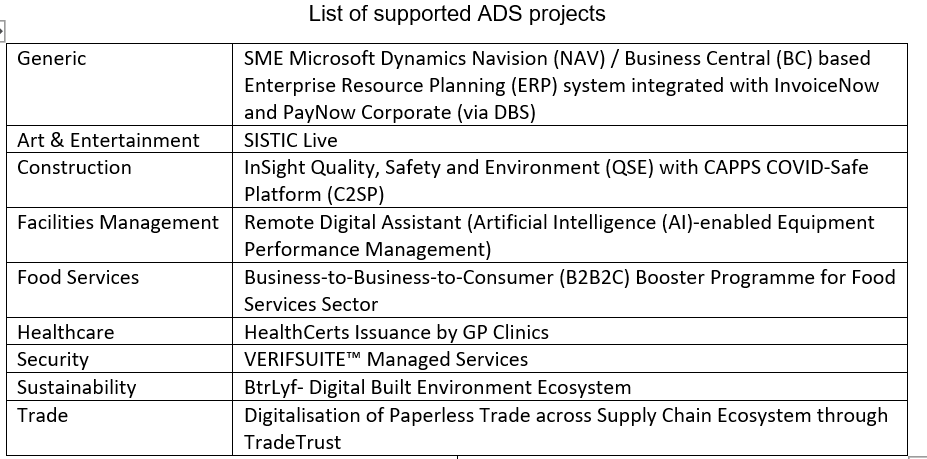

Advanced Digital Solutions (ADS)

ADS promote and amplify the adoption of advanced integrated solutions. To increase firms’ competitive advantage and drive business growth, the Government will be extending support for adoption of cutting-edge digital solutions through the Infocomm Media Development Authority (IMDA)’s Advanced Digital Solutions (ADS) initiative.

From 1 April 2022, the scheme will be expanded to include solutions that leverage Artificial Intelligence (AI) and Cloud technologies, to help enterprises improve operational efficiency and business decisions. Participating enterprises will receive up to 70% funding support for these solutions.

Any business entity that meets the following requirements will be eligible:

- Registered and operating in Singapore;

- Minimum of 30% local shareholding; and

- Group sales turnover less than S$100 million per annum, or group employment less than 200 employees

Enterprises can contact the project leads of the ADS projects they are interested in.

Grow Digital scheme

The Government will also be expanding the Grow Digital scheme, to help businesses better leverage digital platforms to reach international markets.

From 1 April 2022, Grow Digital will be expanded to include more pre-approved digital platforms, so that more businesses can internationalise without requiring an in-market presence. Participating enterprises will receive up to 70% funding support to onboard the B2B and B2C platforms.

Eligibility:

- Business entity registered and operating in Singapore;

- Minimum of 30% local shareholding; and

- Group annual turnover less than S$100 million per annum, or group employment less than 200 employees.

If you are interested to participate as a Grow Digital Partner, please write to SMEs_Go_Digital@imda.gov.sg.

TechSkills Accelerator (TeSA)

The TechSkills Accelerator (TeSA) initiative aims to develop a skilled Information and Communication Technology (ICT) workforce for Singapore’s digital economy, in collaboration with industry partners and the National Trades Union Congress (NTUC). In the coming year, TeSA will expand on several fronts to build a strong Singaporean core of ICT talent. These include:

(i) partnering with industry leaders to grow product development teams in Singapore;

(ii) expanding TeSA to SMEs and startups to provide more job opportunities for mid-career workers; and

(iii) upskilling our current digital workforce to keep their skills relevant.

Encouraging Enterprise and Workforce Transformation

SkillsFuture Enterprise Credit (SFEC)

The SkillsFuture Enterprise Credit (SFEC) encourages employers to undertake enterprise and

workforce transformation initiatives. Eligible employers receive a one-off credit of up to $10,000 to cover up to 90% of out-of-pocket expenses for supportable enterprise transformation programmes and workforce transformation programmes of the $10,000 credit for an eligible employer, $3,000 is ringfenced for workforce transformation initiatives.

The SFEC eligibility criteria have been adjusted in Budget 2022 to expand the coverage of SFEC for the qualifying period from 1 January 2021 to 31 December 2021:

- [New] No minimum Skills Development Levy (SDL) contribution requirement over the qualifying period. However, employers with inactive ACRA status during the qualification process and employers who have defaulted on their SDL payment during the qualifying period will be excluded.

- [No change] Employment of at least three Singapore Citizens or Permanent Residents every month over the qualifying period.

- [No change] Did not qualify in any of the earlier periods.

Tax System

Extend and enhance the Approved Royalties Incentive (ARI)

The ARI was introduced to encourage companies to access cutting-edge technology and know-how for substantive activities in Singapore.

To continue encouraging companies to leverage new technologies and know-how to develop the

capabilities of our local workforce and capture new growth opportunities, the ARI will be extended till 31 December 2028. The ARI will also be simplified to cover classes of royalty agreements based on an activity-set-based approach.

Extend the Approved Foreign Loan (AFL) scheme

The AFL scheme was introduced to encourage companies to invest in productive equipment for the purpose of conducting substantive activities in Singapore. Under the scheme, tax exemption or a concessionary WHT rate may be granted on interest payments made to a non-tax resident for loans to a company to purchase productive equipment.

To continue encouraging companies to invest in productive equipment for the purpose of conducting substantive activities in Singapore, the AFL scheme will be extended till 31 December 2028.

Extend the Tax Framework for Facilitating Corporate Amalgamations under section 34C of the ITA to Licensed Insurer

The tax framework under section 34C of the ITA treats qualifying corporate amalgamations as a continuation of the existing businesses of the amalgamating companies by the amalgamated company for tax purposes. The tax framework minimises the tax consequences arising from a qualifying corporate amalgamation.

To ensure parity in treatment for all companies, including those that are in the insurance business, the tax framework for facilitating corporate amalgamations will be extended to cover amalgamation of Singapore-incorporated companies involving a scheme of transfer under section 117 of the Insurance Act 1966 (IA), where the court order for the confirmation of the scheme referred to under section 118 of the IA is made on or after 1 November 2021.

The extension of the framework is subject conditions, which include the following:

- The amalgamated company takes over all property, rights, privileges, liabilities, and obligations, etc. of the amalgamating company on the date of amalgamation; and

- The amalgamating company becomes dormant (i.e. ceases to conduct any business or any other activities, and does not derive any income) on the date of amalgamation and remains so until it is dissolved or wound up; and

- The amalgamating company is dissolved or wound up before the filing due date of the income tax return for the Year of Assessment (“YA”) related to the basis period in which the scheme of transfer was effected.

Update the GST treatment for travel arranging services

Currently, the GST treatment of the following travel arranging services provided by local suppliers is as follows:

- Services comprising the arranging of international transport of passengers and the arranging of insurance related to such transportation are zero-rated; and

- Services comprising the arranging of accommodation are standard-rated if the property is located in Singapore, and zero-rated if the property is located outside Singapore.

To ensure that our GST system remains resilient in a growing digital economy, the basis for determining whether zero-rating applies to a supply of travel arranging services will be updated, to be based on the place where the customer (i.e. the contractual customer) and direct beneficiary of

the service belong:

- If the customer of the service belongs in Singapore, the travel arranging service will be standard-rated; or

- If the customer of the service belongs outside Singapore and the direct beneficiary either belongs outside Singapore or is GST-registered in Singapore, the travel arranging service will be zero-rated.

This change will ensure that the GST rules accurately reflect the place of consumption of travel arranging services. The change will also ensure parity in GST treatment between local and overseas suppliers on the supplies of travel arranging services. This change will take effect from 1 January 2023.

Integrated Investment Allowance (IIA) scheme to lapse after 31 December 2022

The IIA scheme grants a qualifying company an additional allowance on fixed capital expenditure incurred for qualifying productive equipment placed overseas for approved projects.

The IIA scheme is scheduled to lapse after 31 December 2022.

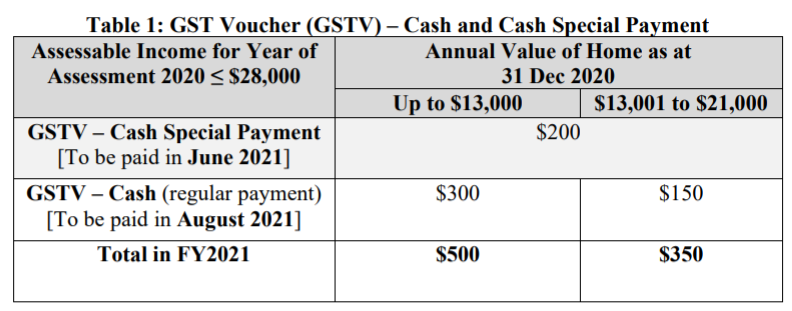

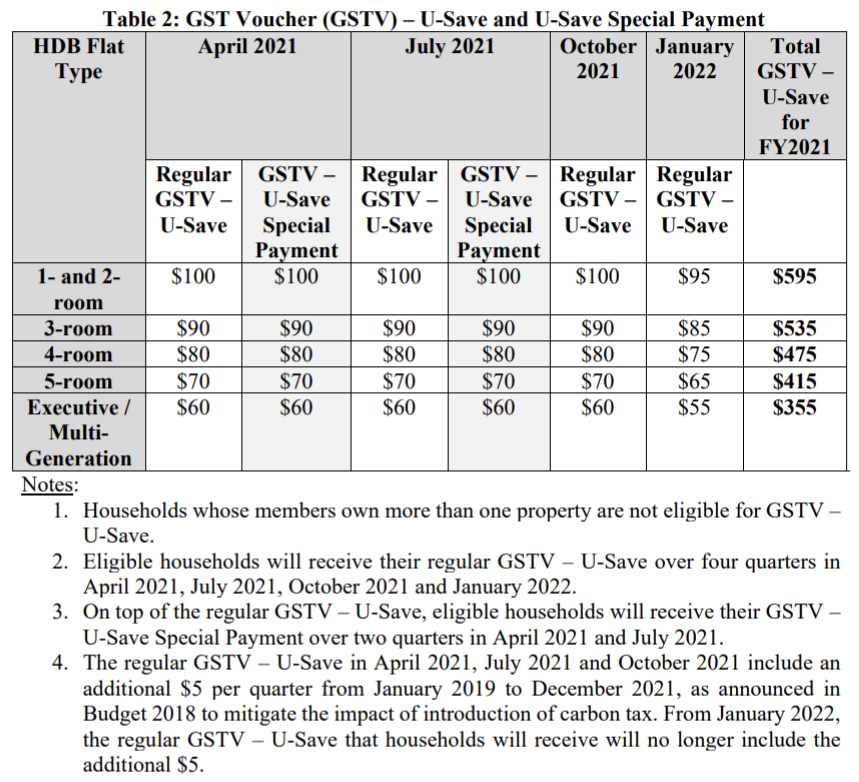

Increase the GST rate

The GST rate has been 7% since 1 July 2007. To meet increased recurrent spending needs, the GST rate will be increased in two steps:

- From 7% to 8% with effect from 1 January 2023; and

- From 8% to 9% with effect from1 January 2024.

Measures To Support Charities

Extension of Tote Board’s Enhanced Fund-Raising Programme (EFR)

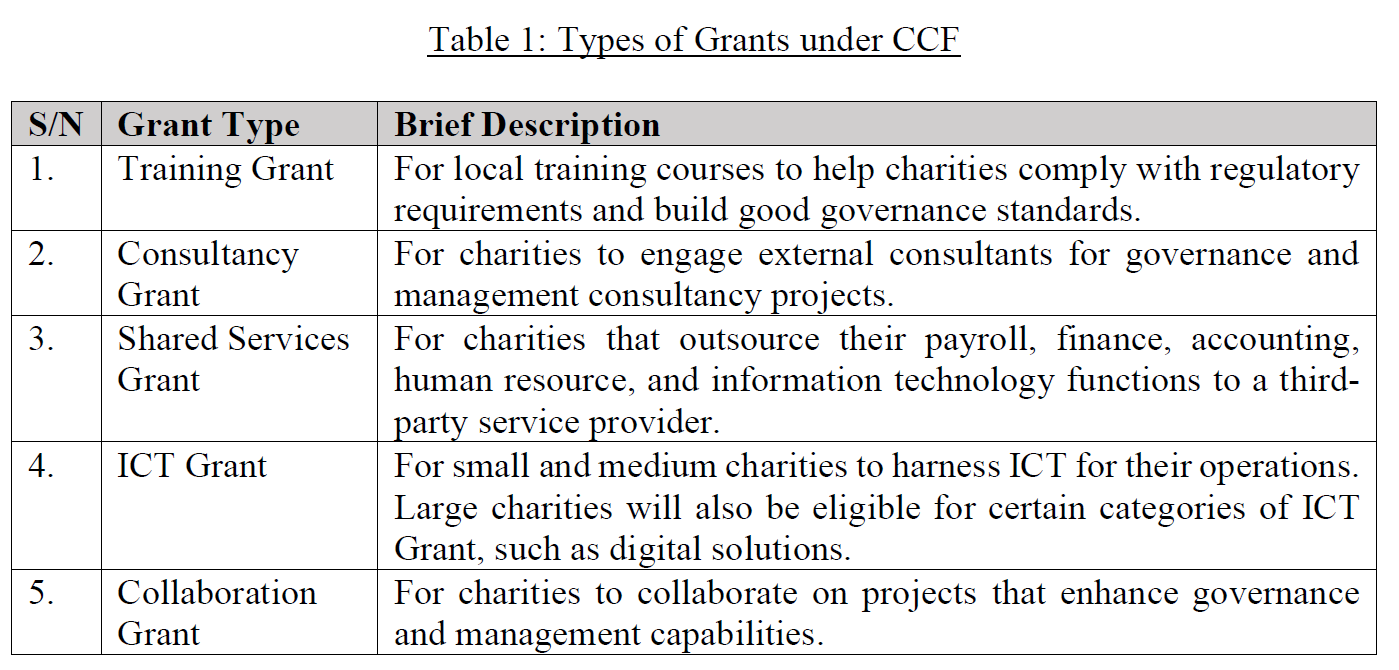

Top-up to the Charities Capability Fund (CCF)

Extension of the One Team Singapore Fund (OTSF)

Top-up to the Cultural Matching Fund (CMF)

The CMF aims to encourage broad-based cultural philanthropy through the provision of dollar-for-dollar matching for private cash donations to eligible arts and heritage charities. To encourage continued giving to the arts and heritage sector, the Government will provide a $150 million top-up to the CMF and extend the scheme for three years, from FY2022 to FY2024.

Foreign Workforce Policies

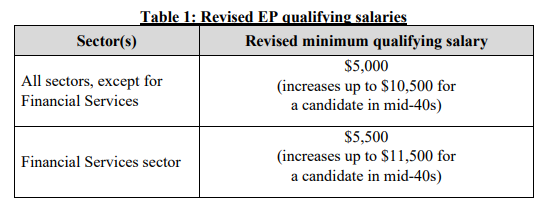

Employment Pass (EP)

The Government will ensure that EP holders are comparable in quality to the top one-third of our local Professionals, Managers, Executives, and Technicians (PMET) workforce. Therefore, the EP minimum qualifying salary will be raised from $4,500 to $5,000. The Financial Services sector will continue to have a higher EP minimum qualifying salary, which will be raised from $5,000 to $5,500.

These changes will apply to new EP applications from 1 September 2022, and to renewal applications from 1 September 2023.

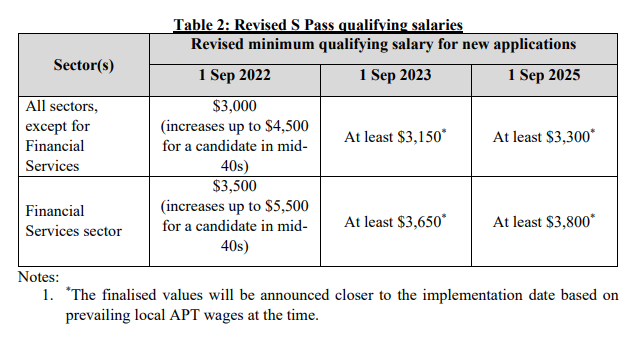

S Pass

The Government will ensure that S Pass holders are comparable in quality to the top one-third of our local Associate Professionals and Technicians (APT) workforce. Therefore, the S Pass minimum qualifying salary will be raised in phases, with the first step on 1 September 2022 for new applications, and subsequently on 1 September 2023 and 1 September 2025. A higher S Pass qualifying salary for the Financial Services sector will also be introduced on 1 September 2022 for new applications.

These changes will apply to renewal applications one year later (e.g. the increase for new applications from 1 September 2022 will only affect renewals from 1 September 2023 onwards).

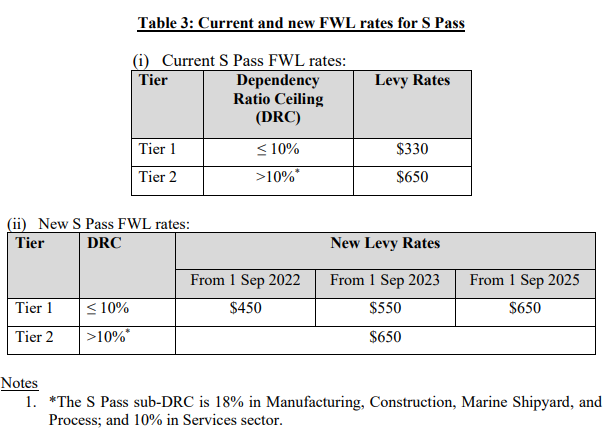

Foreign Worker Levy (FWL) Rates

The Tier 1 S Pass FWL rate will be progressively raised from $330 to $650 by 2025

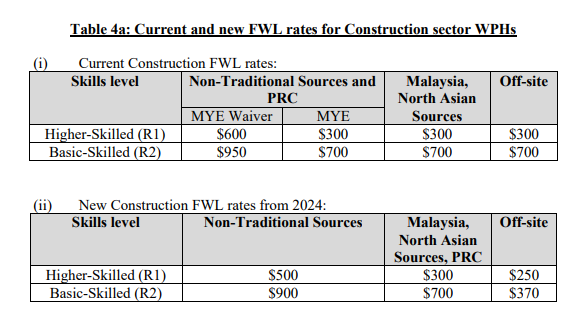

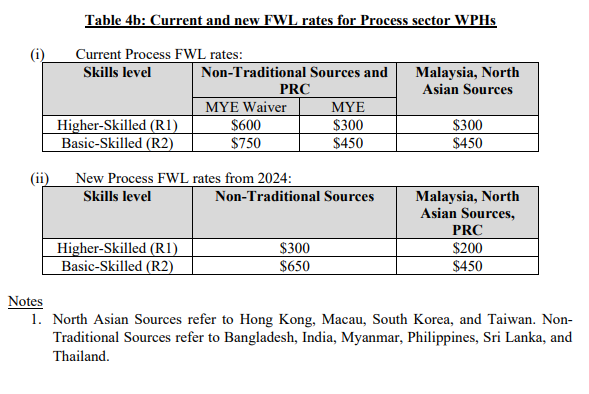

Work Permit Holders in Construction and Process Sectors

From 1 January 2024, the FWL rates for Work Permit holders (WPHs) in the Construction and

Process sectors will be adjusted. The Man-Year Entitlement (MYE) framework in both sectors will also be dismantled.

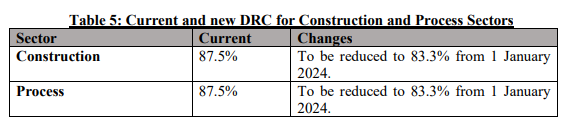

Dependency Ratio Ceiling (DRC)

The DRC will be reduced for the Construction and Process sectors from 1 January 2024.

Uplifting Lower-Wage Workers

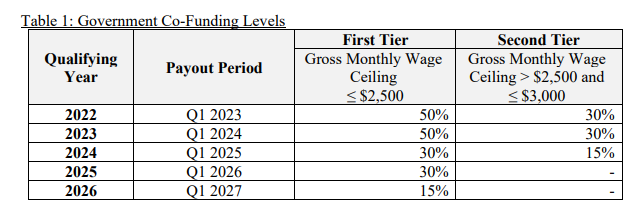

Progressive Wage Credit Scheme

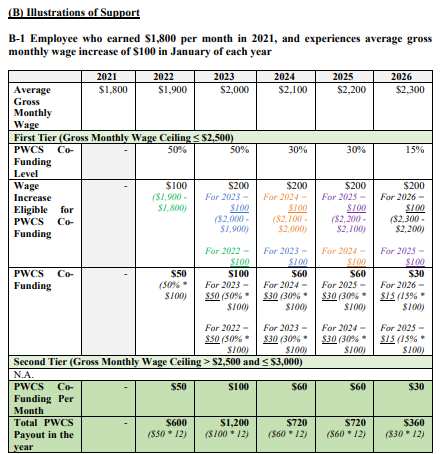

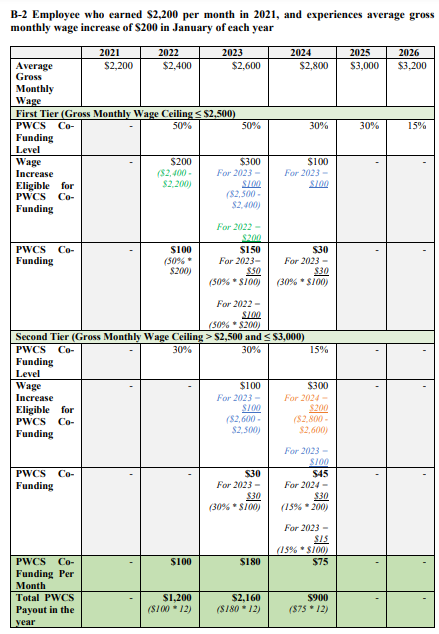

PWCS provides transitional support to employers by co-funding wage increases of lower-age workers between 2022 and 2026. Employers do not need to apply. The Inland Revenue Authority of Singapore (IRAS) will credit payouts for employers that have implemented eligible wage increases into their accounts by the first quarter of the year following the wage increases.

The PWCS has the following features:

-

Targeted at resident lower-wage employees with gross monthly wages of up to $2,500. This support will be provided from 2022 to 2026. The qualifying wage ceiling of $2,500 is aligned to that for the enhanced Workfare Income Supplement scheme.

-

Additional tier of support for employees with gross monthly wages above $2,500 and up to $3,000. In view of the uncertain economic conditions in the immediate term, the Government will provide some support for the wage increases of employees earning above $2,500 and up to $3,000 who marginally miss the first wage tier. This additional support will be provided from 2022 to 2024.

-

Average gross monthly wage increase must be at least $100 to be eligible for the PWCS payout in each qualifying year.

-

Co-fund wage increases in each qualifying year for two years. For example, a 2022 wage increase will be supported in qualifying year 2022, and also in 2023 if sustained. The approach helps employers manage the compounding effect of wage increases year on year.

Workfare Income Supplement Scheme

The Government will enhance the Workfare Income Supplement scheme to supplement the

incomes and CPF savings of lower-wage Singaporean workers, and encourage them to work regularly. Workfare is paid directly to eligible workers. These changes will apply to work done from 1 January 2023.

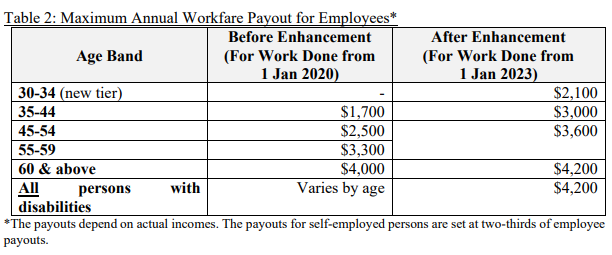

Changes to Workfare Income Supplement Scheme

- Qualifying monthly income cap raised from $2,300 to $2,500.

- Extension of Workfare to those aged 30-34.

- Higher annual Workfare payouts of up to $4,200. Payouts depend on age and income, and have been enhanced across all age bands. Eligible employees can receive up to $4,200 per year in payouts, compared to $4,000 per year today. Older workers will continue to receive the highest payouts. The payouts for self-employed persons are set at two-thirds of employee payouts and will be correspondingly increased.

- All persons with disabilities will qualify for the highest Workfare payout tier (up

to $4,200), regardless of age. - Minimum qualifying monthly income criterion of $500.

Notes:

[1] As PWCS is effective from 2022, wage increases in 2021 (i.e. increases in 2021 from the 2020 wage) will not be supported by PWCS.

[2] Calculation of total PWCS payout in the year assumes that employer makes 12 months of CPF contributions for each qualifying year.

Employee who earned $4,000 per month in 2021, and experiences average gross monthly wage increase of $100 in January of each year

PWCS will not co-fund the wage increases of this employee, as the employee is earning above the wage threshold of $3,000

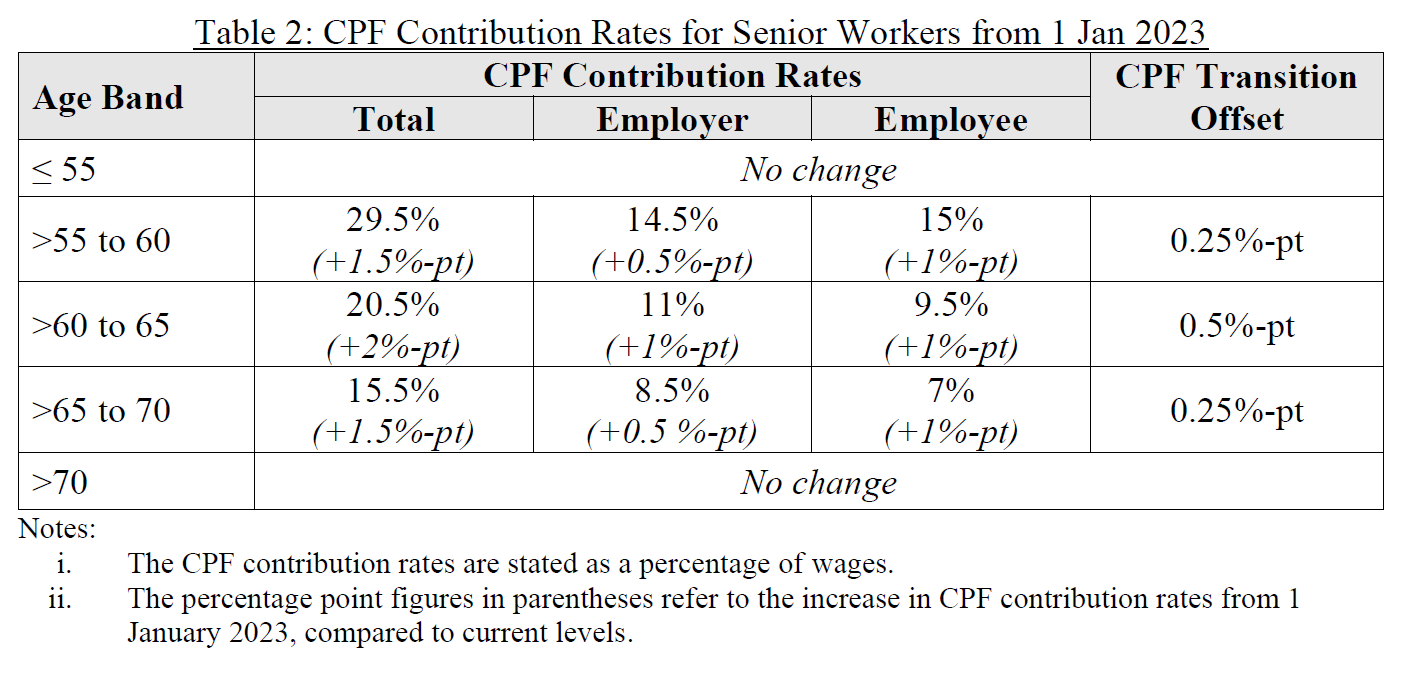

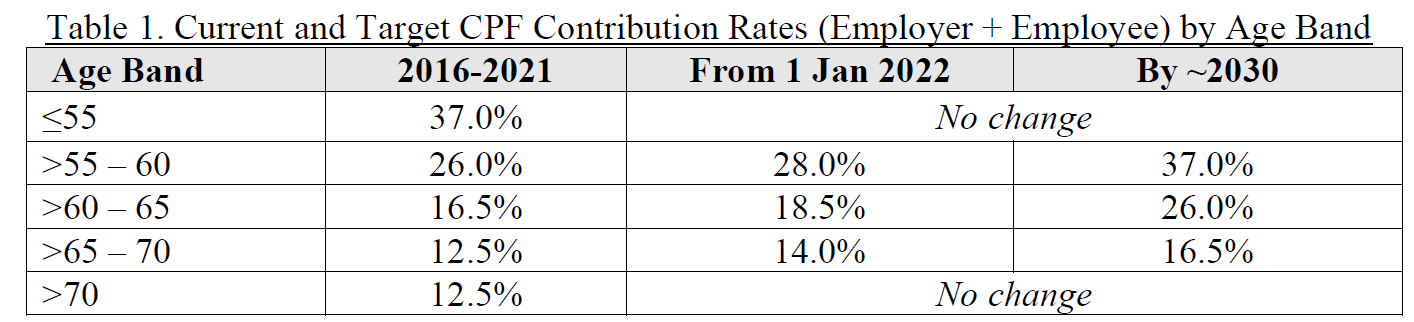

Senior Worker CPF Contribution Rate And CPF Transition Offset

The Government announced that CPF contribution rates will be raised gradually over this decade for Singaporean and Permanent Resident workers aged above 55 to 70

When the increases have been fully implemented, those aged above 55 to 60 will have the same CPF contribution rates as younger employees, and the median 55-year-old member can expect his monthly retirement payouts to be boosted by close to 10% compared to under today’s rates.

The first increase took effect from 1 January 2022. To mitigate the rise in business costs due to the increase of CPF contribution rates in 2022, the Government is providing employers with a one-year CPF Transition Offset equivalent to half of the increase in employer CPF contribution rates for every Singaporean and Permanent Resident worker they employ who is aged above 55 to 70.

The next increase in senior worker CPF contribution rates will take place on 1 January 2023. A similar one-year CPF Transition Offset will be automatically provided for the 2023 increases; employers need not apply.