In Budget 2022, the Minister for Finance announced that the GST rate will be increased from:

(i) 7% to 8% with effect from 1 Jan 2023; and

(ii) 8% to 9% with effect from 1 Jan 2024.

The revenue from the increase in GST will go towards supporting our healthcare expenditure, and to take care of our seniors

Rules for Supplies that span the change of GST rate

A supply spans the change of GST rate where one or two of the following events takes place wholly or partially on or after 1 Jan 2023:

- the issuance of invoice;

- the receipt of payment (or the making of payment in respect of a reverse charge supply);

- the delivery of goods or performance of services.

Invoice issued on or after 1 Jan 2023

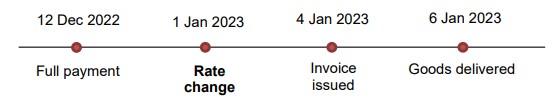

Full payment received before 1 Jan 2023 Goods delivered after 1 Jan 2023

If you issue an invoice for your supply on or after 1 Jan 2023 but you receive full payment before 1 Jan 2023, the supply is subject to 7% GST.

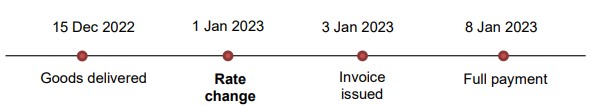

Full payment received after 1 Jan 2023 Goods delivered before 1 Jan 2023

If you issue an invoice for your supply on or after 1 Jan 2023 but you have delivered all the goods or performed all the services before 1 Jan 2023, the entire value of the supply is subject to 7% GST.

Invoice is issued before 1 Jan 2023

Full payment received or Goods delivered before 1 Jan 2023

If you have received full payment before 1 Jan 2023, or if you have delivered all the goods or performed all the services before 1 Jan 2023, the entire value of the supply is subject to 7% GST.

Partial payment received or partial goods delivered before 1 Jan 2023

If you do not receive full payment before 1 Jan 2023 and you have delivered or performed a part or all of the goods or services before 1 Jan 2023, you can elect to charge 7% GST on the higher of:

(a) The payment received is before 1 Jan 2023; or

(b) The value of goods delivered or services performed is before 1 Jan 2023.

The remaining value of the supply will be subjected to 8% GST.

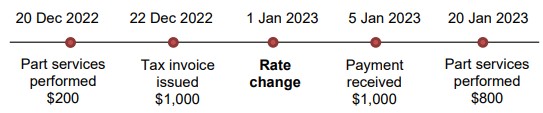

Supply involving invoice issued before 1 Jan 2023 – full payment received after 1 Jan 2023

On 22 Dec 2022, you issue a tax invoice for your supply of services (value of $1,000) and you receive the full payment on 5 Jan 2023. You perform part of the services (value of $200) before 1 Jan 2023 and the remaining part of the services (value of $800) after 1 Jan 2023.

You must charge and account for GST at 7% ($70) for the tax invoice issued to your customer on 22 Dec 2022. As you do not receive any payment and only perform part of the services before 1 Jan 2023, under the transitional rules, you are required to issue the following to your customer by 15 Jan 2023, for that part of the services performed after 1 Jan 2023:

- a credit note for $856 ($800 plus 7% GST of $56); and

- a new tax invoice for $864 ($800 plus 8% GST of $64).

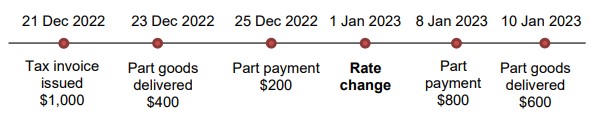

Supply involving invoice issued before 1 Jan 2023 – payments straddle 1 Jan 2023

On 21 Dec 2022, you issue a tax invoice for your supply of services (value of $1,000). Before 1 Jan 2023, you delivered part of the goods (value of $400) and received a payment of $200. After 1 Jan 2023, you receive the remaining payment of $800 and perform delivered the other part of the goods (value of $600).

Under the transitional rules, you are required to issue the following by 15 Jan 2023, for that part of the goods delivered after 1 Jan 2023:

- a credit note for $642 ($600 plus 7% GST of $42); and

- a new tax invoice for $648 ($600 plus 8% GST of $48)