A summary of Unity, Resilience and Solidarity Budget 2020.

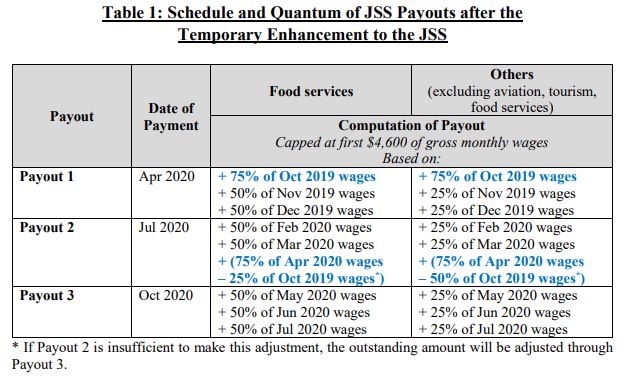

Jobs Support Scheme ("JSS")

The temporary enhancement to the JSS for the month of April 2020 will raise the wage support to 75% in that month. This will apply to the first S$4,600 of gross monthly wages paid to local workers (Singapore Citizens and Permanent Residents) in all sectors.

The first JSS payout (“Payout 1”) has been brought forward to April 2020.Employers, who are on PayNow or have a Giro account with IRAS, will receive their payment in mid-April. Other employers will start to receive their cheques

the following week.

Self-Employed Person Income Relief Scheme ("SIRS")

As part of the Solidarity Budget, the Ministry of Manpower (MOM) will enhance the Self-Employed Person (SEP) Income Relief Scheme (SIRS) to broaden support for SEPs affected by Covid-19 and tide them through this period of economic uncertainty. Eligible SEPs will receive three quarterly cash payouts of $3,000 each in May, July and October.

1. WIth the two key enhancements, Singaporean SEPs who meet all of the following criteria will be eligible for SIRs:

-

- Started work as an SEP on or before 25 March 2020

- Currently earn a Net Trade Income (NTI) of not more than $100,000.;

- If SEP also has employment (i.e. dual status worker), the income earned as an employee must be not more than $2,300/month;

- Live in a property with an AV not more than $21,000; and

- Do not own two or more properties.

2. For married Singaporean SEPs, the following additional criteria apply::

-

- The individual and spouse together do not own two or more properties; and

- The Assessable Income of his/her spouse does not exceed $70,000.

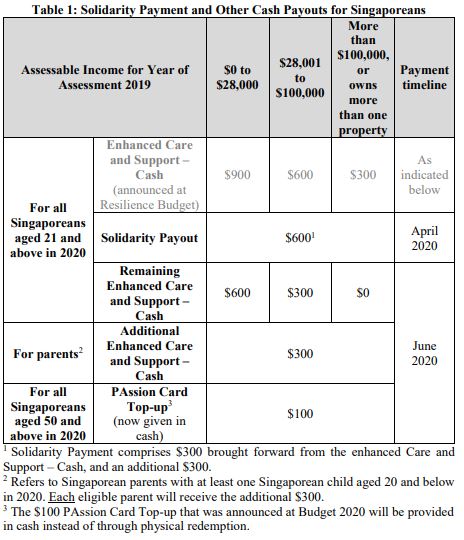

Care and Support Package

All Singaporeans aged 21 and above this year will receive a one-off Solidarity Payment of S$600 in cash. This will be done by bringing forward S$300 from the earlier announced enhanced Care and Support – Cash, and the Government topping up an additional S$300.

Most eligible citizens will receive their Solidarity Payment by 14 April 2020.

Eligible citizens will be notified of their payment via SMS, from 15 April 2020.

The other cash payouts that were earlier announced in the Resilience Budget under the enhanced Care and Support Package will be paid out in June 2020 (brought forward from August and September 2020).

These include:

- Remaining enhanced Care and Support – Cash of S$300 and S$600, for lower- and middle-income adult Singaporeans;

- Additional enhanced Care and Support – Cash of $300 for Singaporean parents with at least one Singaporean child aged 20 and below this year; and

- PAssion Card Top-up of S$100 for all Singaporeans aged 50 and above this year.

This will be paid out in cash instead of through physical redemption, in consideration of safe distancing.

Cash Flow & Credit Support for Employers

To support enterprises, the Government will be helping employers with cash flow and credit:

- Waiver of monthly Foreign Worker Levy (FWL) due in April 2020 to help firms with cash flow

- FWL rebate of $750 in April 2020 from levies paid this year, for each Work Permit or S Pass holder

- Laws to ensure property owners pass on Property Tax rebate to tenants.

- 1-month rental waiver for office, industrial, and agriculture tenants of Government agencies

- Government’s risk share raised from 80% to 90% for EFS-Trade Loan, EFS-SME Working Capital Loan, and Temporary Bridging Loan Programme (applies to loans initiated from 8 April 2020 till 31 March 2021)

Self-Employed Person Training Support Scheme

The training allowance is increased to S$10.00 an hour with effect from 1 May 2020.

Workfare Income Supplement Scheme ("WIS")

The Workfare Special Payment is increased to S$3,000, which will be paid over two equal payments of S$1,500 each, in July and October 2020.

COVID-19 Support Grant

The scheme eligibility criteria are as follows:

- Singapore Citizens or Permanent Residents, aged 16 years and above,

- who are presently unemployed due to retrenchment or contract termination as a result of the economic impact of the COVID-19 situation, and meet all of the following:

- Had a monthly household income of not more than $10,000, or per capita household income not more than $3,100 per month prior to unemployment;

- Lives in a property with an annual value of not more than $21,000; and

- Not currently receiving ComCare Short-to-Medium Term Assistance(SMTA) or ComCare Interim Assistance.

- The applicant must have been employed as a full-time, or part-time permanent, or contract staff prior to unemployment.

Successful applicants will receive a monthly cash grant of S$800, for three months.

The scheme will be open for application from May 2020 to September 2020.

Individuals who are eligible may submit their application at their nearest Social Service Office,

Deferment of Income Tax Payments for Companies

All companies with Corporate Income Tax (CIT) payments due in the months of April, May and June 2020 will be granted an automatic three-month deferment of these payments.

The CIT payments deferred from April, May, and June 2020 will instead be collected in July, August, and September 2020 respectively.

No application is required.

Deferment of Personal Income Tax (PIT) Payments for Self-Employed Persons (SEPs)

All SEPs are to file their personal income tax (PIT) returns for YA 2020 by 18 April 2020. SEPs will be granted an automatic three-month deferment of their PIT payments due in the months of May, June and July 2020. The PIT payments deferred from May, June, and July 2020 will instead be collected in August, September, and October 2020 respectively.

Rental Waivers for Tenants in Government-Owned / Managed Non-Residential Facilities

Stallholders at hawker centres and markets managed by the National Environment Agency (NEA) will be given three months’ worth of rental waiver, with a minimum waiver of $200.

Commercial tenants in other government-owned or managed facilities will be provided with two months’ worth of rental waivers.

Other Non-Residential Tenants. Government agencies such as JTC, SLA, HDB, URA, BCA, NParks, and PA will provide half a month’s worth of rental waiver to eligible tenants of other non-residential premises who do not pay Property Tax. Eligible tenants/lessees may include those in premises used for

industrial or agricultural purpose, or as an office, a business or science park, or a petrol station.

Enhanced Property Tax Rebate for Non-Residential Properties

For the tourism sector:

- Property Tax Rebate of 100% for the year 2020, for the accommodation and function room components of licensed hotels and serviced apartments, and prescribed Meetings, Incentives, Conventions, and Exhibitions (MICE) venues.

- International cruise and regional ferry terminals will receive a 100% Property Tax Rebate, and

- the Integrated Resorts will receive a 60% Property Tax Rebate.

For the aviation sector:

- 100% Property Tax Rebate for Changi Airport

For other non-residential properties:

- 30% Property Tax Rebate

Enterprise Development Grant (EDG)

The Enterprise Development Grant (EDG) provides supports projects under 3 categories:

Core Capabilities

Projects under Core Capabilities help businesses prepare for growth and transformation by strengthening their business foundations.

Productivity

Projects under Innovation and Productivity support companies that explore new areas of growth, or look for ways to enhance efficiency.

Market Access

Projects under Market Access support Singapore companies that are willing and ready to venture overseas.

From 1 April 2020 to 31 December 2020, the support level will be raised from up to 70% to up to 80%. For enterprises that are most severely impacted by COVID19, the maximum support level will be further raised to 90% on a case-by-case basis.

Productivity Solutions Grant (PSG)

From 1 April 2020 to 31 December 2020, the maximum support level will be raised from 70% to 80%.

SMEs Go Digital

The SMEs Go Digital programme aims to help SMEs use digital technologies and build stronger digital capabilities to seize growth opportunities in the digital economy.

From 1 April 2020 to 31 December 2020, the scope of pre-approved digital solutions will be expanded to cover:

- Online collaboration tools;

- Virtual meeting and telephony tools;

- Queue management systems; and

- Temperature screening solutions.

The list of digital solutions fro PSG can be found on the Tech Depot

(www.smeportal.sg/content/tech-depot/en/home.html).

SMEs that are looking for visitor registration and contact tracing tools can access free trials provided by the tech industry

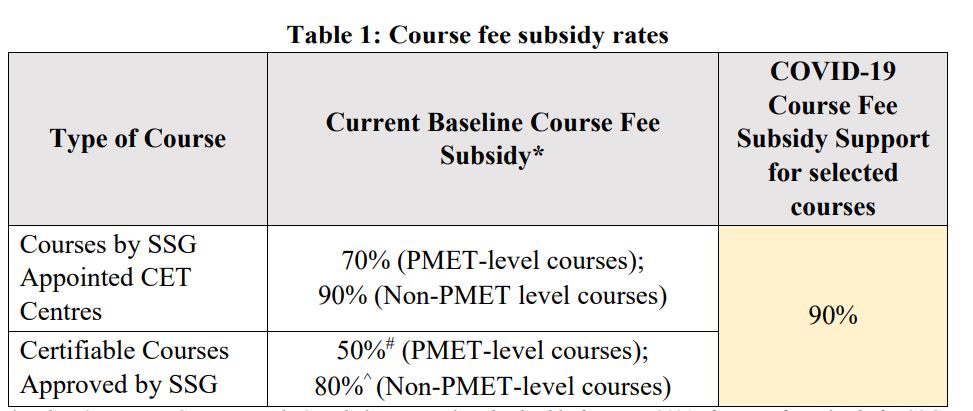

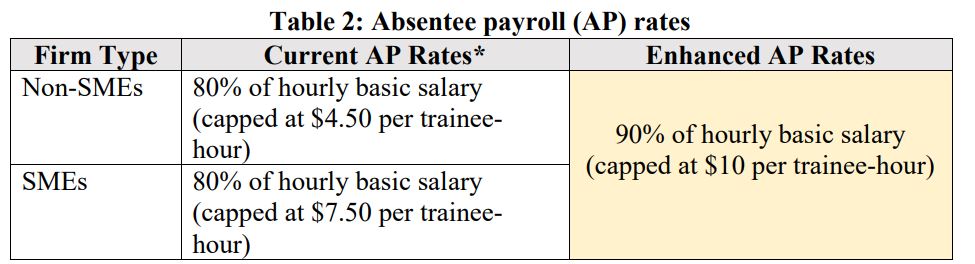

Stabilisation and Support Package (SSP) - Course fee subsidy

Under the Stabilisation and Support Package (SSP), SSG is providing 90% course fee subsidies and absentee payroll (AP) rates for employers in sectors directly affected by the COVID-19 outbreak (i.e. air transport, tourism, retail, and food services), when they sponsor their workers for eligible courses.

These enhancements will last for three months.

SG Together Enhancing Enterprise Resilience (STEER)

STEER supports funds set up by the Trade Associations and Chambers (TACs) or industry groupings, with the aim of helping businesses tide over the challenges arising from COVID-19, and to push on with transformation efforts in preparation for economic recovery.

From 1 April 2020, Enterprise Singapore will match S$1 for every S$2 raised by such industry-led funds, up to S$1 million per fund.

E-invoicing Registration Grant

Businesses registered on the nationwide e-invoicing network on or before 31 December 2020 will receive a one-time grant of S$200. Businesses can register through more than 50 Peppol-ready accounting and ERP solutions. Once registered on the nationwide e-invoicing network, businesses will be able to send and receive e-invoices through the network.

Businesses incorporated on or before 25 March 2020 and registered on the network on or before 31 December 2020 will automatically receive their grant via PayNow Corporate.

There is no need to apply for the grant.

Advanced Digital Solutions

IMDA and Enterprise Singapore will provide up to 80% funding support for enterprises to adopt advanced digital solutions from 1 May 2020 to 31 December 2020.

Examples include:

- Advanced security and facilities management systems for buildings – cluster guarding, digital concierges, sensors and analytics for energy management and predictive maintenance, smart toilet systems, and mobile robots for security and/or cleaning. These solutions will help enterprises balance the need to minimise physical contact among staff, with the increased demand for security, cleaning and maintenance. It will also help to integrate security,

cleaning and maintenance for more seamless facilities management. - Integrated Business-to-Business (B2B) systems to facilitate end-to-end

transactions between buyers and sellers. These would help enterprises transit from manual/paper transactions to electronic transactions by covering interlinked transactions such as e-procurement, e-invoicing, e-payments, and inventory management.

Enterprise Financing Scheme – SME Working Capital Loan

Maximum loan quantum: S$1,000,000

Maximum repayment

period: 5 years

Government’s risk-share: 80%.

Interest rate: Subject to assessment by Participating Financial Institutions (PFIs)

Principal Payment Deferment: SMEs may request for deferment of principal repayment for 1 year, subject to assessment by PFIs

Enterprise Financing Scheme – Trade Loan

The Enterprise Financing Scheme – Trade Loan supports Singapore-based enterprises’ trade financing needs, which include the financing of short-term import, export, and guarantee needs.

Maximum loan quantum: $10,000,000 per borrower group,

Maximum repayment

period: 1 year

Government’s risk-share: 80%.

Interest rate: Subject to assessment by Participating Financial Institutions (PFIs)

Loan Insurance Scheme (LIS)

The Loan Insurance Scheme helps SMEs secure short-term trade loans by having commercial insurers co-share loan default with Participating Financial Institutions. A portion of the insurance premium paid by SMEs to insurers is supported by the Government.

Maximum loan quantum insured: Subject to assessment by Commercial Insurers and Participating Financial Institutions

Maximum insured period: 1 year

Government’s subsidy on

insurance premium: 80%

Temporary Bridging Loan Programme (TBLP)

The Loan Insurance Scheme helps SMEs secure short-term trade loans by having commercial insurers co-share loan default with Participating Financial Institutions. A portion of the insurance premium paid by SMEs to insurers is supported by the Government.

Sector Coverage: All sectors

Maximum loan quantum: S$5,000,000 per borrower group

Maximum repayment

period: 5 years

Government’s risk-share: 80%

Interest rate: Capped at 5% per annum

Principal Payment Deferment: Enterprises may request for deferment of principal repayment for 1 year, subject to assessment by PFIs

Government fees and charges

All government fees and charges are freeze. i.e. No incremental of fees and charges.

All agencies will continue to collect fees and charges.

Temporary Relief Fund

Some families may require help urgently may apply for Temporary Relief Fund in the month of April, to provide them with immediate financial assistance.

This will be available at Social Service Offices and Community Centres.

SGUnited Traineeships programme

Workforce Singapore (WSG) will co-share manpower costs with enterprises that offer up to 8,000 traineeships targeted at local first-time jobseekers this year.

Firms that offer traineeships targeted at local first-time job seekers this year can receive funding from government agency Workforce Singapore (WSG) under this SGUnited Traineeships programme.

These will include science and technology stints in research and development labs, deep-tech start-ups, accelerators and incubators, said DPM Heng.

Participants will receive an allowance co-funded by the Government and firm they are attached to.

SGUnited Jobs Initiative

10,000 jobs will start with the public sector recruiting for long-term roles in essential services such as social services, early childhood education and infocomm technology.

Temporary jobs to handle the increase in Covid-19-related operations will also be available in roles such as health declaration assistants and temporary management support officers.

Private sector job opportunities will also be identified together with the Singapore Business Federation and other trade associations and chambers.

There will be a series of SGUnited Jobs Virtual Career Fair (VCFs) upcoming up. More details of subsequent runs of the SGUnited Jobs VCF will be made available at a later date.