Jobs Support Scheme ("JSS")

Current Treatment

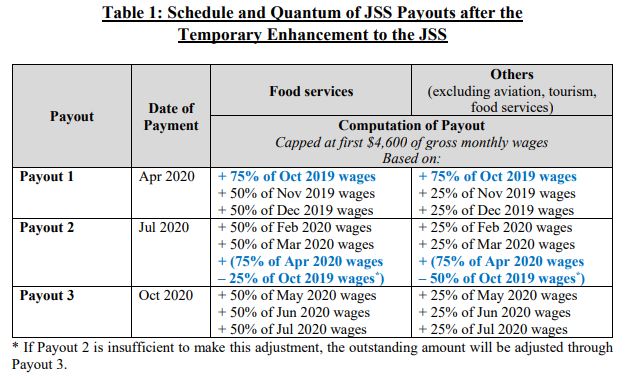

Employers will receive a cash grant on the gross monthly wages of each local employee (applicable to Singapore Citizens and Permanent Residents only) of :

- 50% for food and service industry,

- 75% for the aviation and tourism sectors, and

- 25% for rest of the industry for the months of October 2019 to July 2020,

subject to a monthly wage cap of S$4,600 per employee.

Employers do not need to apply for the JSS. The grant will be computed based on CPF contribution data.

Employers can expect to receive the JSS payment from the Inland Revenue Authority of Singapore (IRAS) by May 2020.

Wages paid to business owners will not be eligible for the grant.

New Treatment

The temporary enhancement to the JSS for the month of April 2020 will raise the wage support to 75% in that month. This will apply to the first S$4,600 of gross monthly wages paid to local workers (Singapore Citizens and Permanent Residents) in all sectors.

The first JSS payout (“Payout 1”) has been brought forward to April 2020.

For April 2020 payment, the government will give an Cash Grant of up to 75% of Oct 2019 wages. Subsequently, the Cash Grant in July 2020 will be adjusted downwards by 50% of Oct 2019 wages.

Care and Support Package

Current Treatment

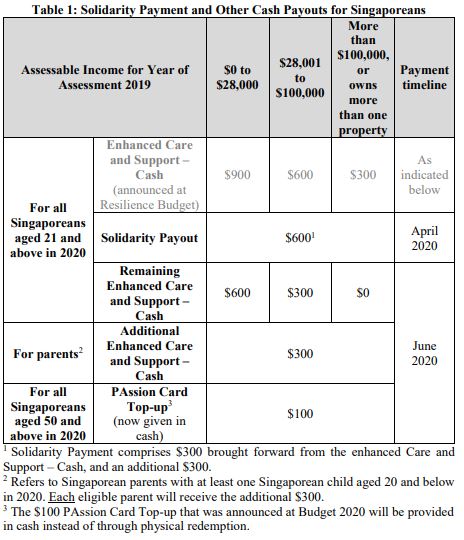

All Singaporeans aged 21 years and above in 2020 will receive a one-off Care and Support – Cash payout of S$900, S$600 or S$300, depending on their income.

Those who own more than one property will receive S$300, regardless of their income.

Parents, with at least one Singaporean child aged 20 and below in 2020, will each receive an additional S$300 in cash.

New Treatment

All Singaporeans aged 21 and above this year will receive a one-off Solidarity Payment of S$600 in cash. This will be done by bringing forward S$300 from the earlier announced enhanced Care and Support – Cash, with the Government topping up an additional S$300.

Most eligible citizens will receive their Solidarity Payment by 14 April 2020.

Eligible citizens will be notified of their payment via SMS, from 15 April 2020.

The other cash payouts that were earlier announced in the Resilience Budget under the enhanced Care and Support Package will be paid out in June 2020 (brought forward from August and September 2020).

These include:

- Remaining enhanced Care and Support – Cash of S$300 and S$600, for lower- and middle-income adult Singaporeans;

- Additional enhanced Care and Support – Cash of $300 for Singaporean parents with at least one Singaporean child aged 20 and below this year; and

- PAssion Card Top-up of S$100 for all Singaporeans aged 50 and above this year.

This will be paid out in cash instead of through physical redemption, in consideration of safe distancing.

Self-Employed Person Income Relief Scheme ("SIRS")

Current Treatment

Eligible self-employed persons will receive S$1,000 a month for nine months.

New Treatment

More SEPs will qualify for SIRS

- Automatic inclusion for SEPs who also earn a small income from employment work

- Enhanced Annual Value of property criterion of $21,000, up from $13,000 previously

Eligible SEPs will receive three quarterly cash payouts of $3,000 each in May, July, and October 2020. Other criteria remain unchanged.

Cash Flow & Credit Support for Employers

Current Treatment

Not applicable.

New Treatment

To support enterprises, the Government will be helping employers with cash flow and credit:

- Waiver of monthly Foreign Worker Levy (FWL) due in April 2020 to help firms with cash flow

- FWL rebate of $750 in April 2020 from levies paid this year, for each Work Permit or S Pass holder

- Laws to ensure property owners pass on Property Tax rebate to tenants.

- 1-month rental waiver for office, industrial, and agriculture tenants of Government agencies

- Government’s risk share raised from 80% to 90% for EFS-Trade Loan, EFS-SME Working Capital Loan, and Temporary Bridging Loan Programme (applies to loans initiated from 8 April 2020 till 31 March 2021)