Rental Relief

The rental relief framework, comprising the Rental Relief and the Additional Rental Relief, applies to eligible tenant-occupiers of prescribed properties in qualifying leases or licences that are in writing, or evidenced in writing, which are:

a) (i) Entered into before 25 March 2020; or (ii) entered into before 25 March 2020 but expired and renewed either automatically or in exercise of a right of renewal in the contract; and

b) In force at any time between 1 April and 31 July 2020 for qualifying commercial properties, and between 1 April and 31 May 2020 for other non-residential (e.g. industrial/office) properties.

Rental Relief

Tenant-occupiers must fall in the following category to be eligible for Rental Relief:

a) Small and Medium Enterprises (SMEs) with not more than S$100 million in annual revenue for the Financial Year 2018 or a later appropriate period where applicable, at the individual or entity level

- If the tenant-occupier has not carried on business for 12 months or longer as at the last day of its financial year ending on a date in the year 2018, but has carried on business for 12 months or longer as at last day of its financial year ending on a date in the year 2019, the reference period will be FY2019 instead. Id the foregoing does not apply, but the tenant-occupier has carried on business for 12 months or longer as at the last day of its financial year ending on a date in the year 2020, where the date is on or before March 2020, the reference period will be FY 2020. For any other case, the tenant-occupier’s average monthly revenue from the time the tenant-occupier commenced business until 31 March 2020 (both dates inclusive) will be extrapolated for comparison against the $100 million annual revenue threshold.

Additional Rental Relief

The Additional Rental Relief will apply to tenant-occupiers who qualify for Rental Relief, have carried on business at the rented property before 25 March 2020 and meet the following additional criteria:

(a) The tenant-occupier is a company/entity incorporated in Singapore, and if it is a member of a Singapore group of entities during the period 1 Apr 2020 to 31 May 2020, the aggregate revenue for such a group is not more than S$100 million for the Financial Year 2018 or a later appropriate period where applicable; and

(b) The tenant-occupier suffered at least a 35% drop in average monthly gross income at the outlet level from 1 Apr to 31 May 2019, or alternative period if the tenant-occupier was not operational as of 1 Apr 2019.

Note: If the tenant-occupier commenced business after 1 Apr 2019, comparison will be against the period from the date of commencement of business to 24 Mar 2020 (both dates inclusive) to ascertain the decrease of 35% or more.

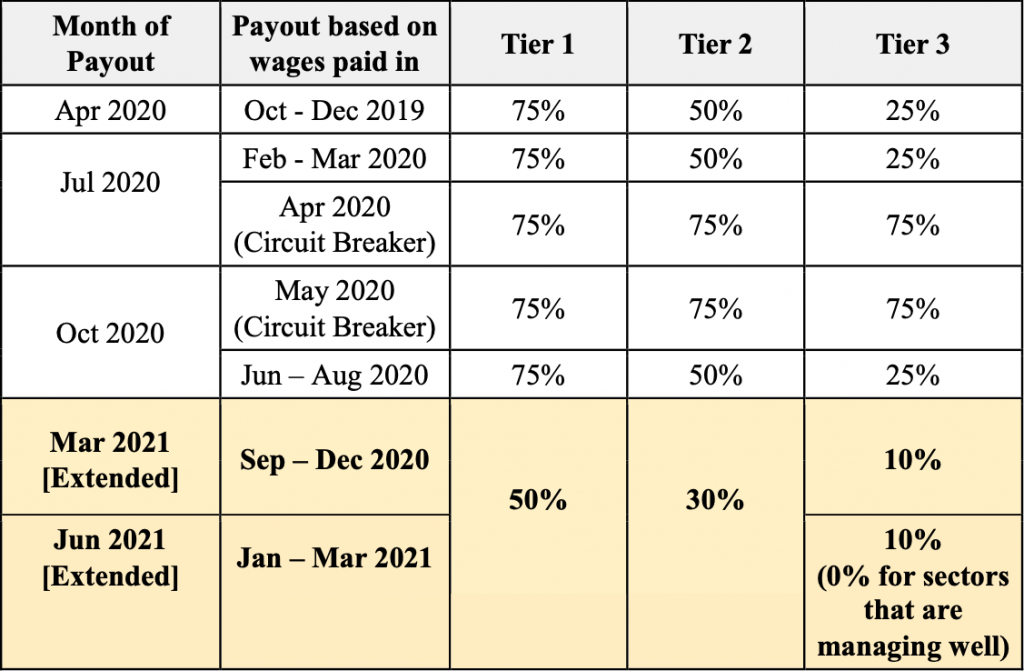

a) Rental Relief for eligible SME tenants (supported by Government assistance):

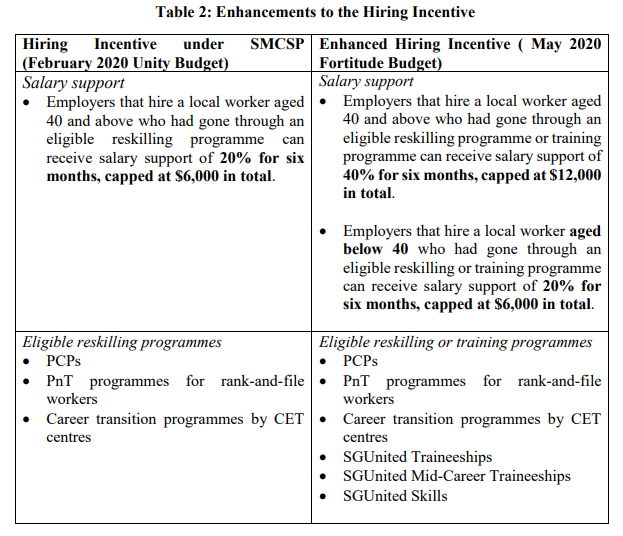

Eligible tenant-occupiers in qualifying commercial properties and other non-residential properties will receive the rental relief through a waiver of rent from their landlords. Property owners will receive support through the: (a) Property Tax Rebate for Year 2020 announced in the Unity and Resilience Budgets; and (b) Government cash grant announced in the Fortitude Budget.

Eligible SMEs in qualifying commercial properties will receive up to 2 months’ waiver of their rent, and eligible SMEs in other non-residential properties (e.g. industrial and office properties) will receive up to 1 months’ waiver of their rent.

b) Additional Rental Relief for SME tenants (supported by landlords/ property owners):

Eligible SME tenant-occupiers who have seen a 35% or more drop in their average monthly gross income due to COVID-19 will receive up to an additional 2 months’ waiver of rent for qualifying commercial properties, and up to an additional 1 month’s waiver of rent for other non-residential properties (e.g. industrial and office properties).

For more details on the definitions of property in each category, please refer to this.

*The value of the rent to be waived is based on the contractual rent of the tenant, excluding any maintenance fee and charges for the provision of services such as cleaning and security.

An intermediary landlord will be required to provide a full waiver to their tenant according to the applicable rental relief period.

- In such a case, the tenant-occupier should provide its unaudited balance-sheet, profit and loss statement and cash flow statement for the period from the date of commencement of the business (at the prescribed property or any other place) to 31 March 2020 (both dates inclusive), supported by a statutory declaration by the tenant or (if the tenant is an entity) a relevant officer of the tenant.

- If however, the above is also not available, the tenant should provide a statutory declaration by the tenant or (if the tenant is an entity) a relevant officer of the tenant stating that the revenue of the tenant, calculated using the formula 12xA is not more than $100 million, where A is the average monthly revenue from the business for the period from the date of commencement of the tenant’s business to 31 March 2020 (both dates inclusive).

- A statutory declaration made in Singapore must be in the form set out in the First Schedule of the Oaths and Declarations Act (Cap. 211) and be made before a Commissioner for Oaths.

The Act provides for a moratorium on enforcement actions against eligible tenant-occupiers for non-payment of rent. Among other things, landlords are prohibited from taking the following actions on the tenant-occupier or the tenant-occupier’s guarantor/surety in relation to the non-payment of rent:

a) Terminating the lease or licence agreement;

b) Exercising the landlord’s right of re-entry or forfeiture under the lease or licence agreement; and

c) Starting or continuing court or insolvency proceedings.

This moratorium does not apply to tenants that are not tenant-occupiers, i.e. they are not operating on the property. It also does not apply to tenant-occupiers that do not meet the criteria for the rental relief, i.e. they are not a SME as defined. The moratorium also does not suspend interest due under lease agreements or license agreement. The moratorium ends when IRAS issues the notice of cash grant to the property owner, or on 31 December 2020 if no such notice is received before then.

If a landlord and tenant-occupier are unable to reach a compromise, the property owner and/or any intermediary landlord(s) may make an application using the prescribed form here within 10 working days after receiving (a copy of) the notice of cash grant, to have a rental relief assessor ascertain whether the tenant-occupier is eligible for Rental Relief and/or Additional Rental Relief. Please refer to the section Application for Assessment for details.

Under the Act, the rent that is payable by eligible tenants to their landlord for the relevant period of rental waiver is statutorily waived once qualifying property owners with eligible tenant-occupiers receive the notice of the cash grant issued by IRAS. This means that as an eligible tenant-occupier you do not need to pay rent for those months.

In the case where tenants have already paid rent for those months for which rent is waived, tenants can apply the rental waivers towards the next most immediate months of rent. If there is insufficient time left in the lease, tenants can obtain a refund from the landlord.

In cases where landlords had earlier provided assistance to their tenants or reached an agreement to provide assistance to their tenants, in the form of monetary payments or reduction of payments due under the lease agreement, or landlords have passed on the benefit of any Property Tax Rebate for Year 2020 in respect of the property, these can be offset from the landlords’ rental waiver obligations.

The Property Tax Rebate for Year 2020 for non-residential properties and the Government cash grant are based on the Annual Value of the property. This may not be equivalent to the rental waiver to be provided by landlords, which is based on the contractual rent. Tenants will still have to pay for maintenance fee and charges for the provision of services such as cleaning and security. Nevertheless, the landlord is obliged to provide the rental waiver based on the contractual rental as defined, not based on grant by the Government. The Property Tax Rebate and Government cash grant are not intended to cover the full amount of rental waivers exactly.

The Government recognises that there are landlords who may face genuine financial hardship.Landlords who meet all the following criteria may apply to a rental relief assessor to reduce the amount of Additional Rental Relief they have to provide:

a) The applicant landlord must be an individual or a sole proprietor and is the owner of the prescribed property;

b) The aggregate of the annual value of all investment properties (including the prescribed property) owned (whether solely or jointly with another person and whether directly or through one or more investment holding companies) is not more than S$60,000 as at 13 April 2020; and

c) The rental income derived from the property in question in Year of Assessment 2019 constituted 75% or more of the landlord’s gross income.

If the landlord meets the grounds of financial hardship above, the rental relief assessor may halve the amount of Additional Rental Relief to be borne by the landlord, i.e. one month’s rental waiver for qualifying commercial properties, or half a month’s rental waiver for other non-residential properties (e.g. industrial and office properties). The remaining rent payable will be borne by the tenant.

Property Tax Rebate

*Property Tax Rebate is different from Rental Relief

| Property Type | Component | Tax Rebate |

|---|---|---|

| Hotel | Hotel Rooms | 100% |

| Function Rooms | 100% | |

| Shops, restaurants, gym, tenements such as space for vending machine, base station and tour desk | 100% | |

| Offices that are not used in connection with the operation of the hotel such as serviced offices | 30% | |

| Retail Mall | Shops and restaurants | 100% |

| Offices | 30% | |

| Office Building | Offices | 30% |

| Shops and restaurants | 100% | |

| In-house gym that are used exclusively by the occupants of the office building | 30% |

Owners of qualifying properties are required to unconditionally and fully pass on to their tenant(s) the rebate for the property tax account that is attributable to the rented property based on the period it was rented out, by either reducing or offsetting current or future rentals or through a payment to their tenant(s), within the prescribed timeframe.

Failure to properly pass on the rebate, or to keep the records (e.g. information on the amount, manner and time of pass on) until 31 Dec 2023, without reasonable excuse, is an offence. Those guilty of such an offence shall be liable on conviction to a fine not exceeding $5,000.

The property owners are to continue to pass on the rebate to their tenants despite any outstanding objections lodged for the year 2020.