Budget 2021, with the theme Emerging Stronger Together, combines measures to help families, workers and businesses weather the Covid-19 crisis in the immediate term, with measures to accelerate structural adaptations for the long term.

Tax Changes - GST

Extend GST to (i) goods imported via air or post that are valued up to (and including) the current GST import relief threshold of S$400 (“low-value goods”), and (ii) business-to-consumer (“B2C”) imported non-digital services, through the extension of the Overseas Vendor Registration and reverse charge regimes

Existing Tax Treatment

Currently, low-value goods that are worth $400 or less and are imported via air or post are not subject to GST.

All goods imported via land or sea are already taxed, regardless of value.

B2C imported non-digital services (such as live interaction with overseas providers of educational learning, fitness training, counselling and telemedicine) are also not subject to GST.

New Tax Treatment

GST will be extended to:

a) Low-value goods which are imported via air or post. This will be effected via the Overseas Vendor Registration and reverse charge regimes. Jurisdictions that have extended their GST or Value Added Tax (“VAT”) regimes to cover imported low-value goods include Australia, New Zealand, Norway, Switzerland, and the United Kingdom.

b) B2C imported non-digital services. This will be effected via the Overseas Vendor Registration regime. Jurisdictions which already tax similar services include Australia and New Zealand.

This change will take effect from 1 January 2023.

Enterprise Financing Scheme - Venture Debt Programme

A programme aimed at startups, where Government takes up to 70% of the risk on loans with participating institutions.

- Increase cap on loan quantum from $5 million to $8 million

- Expecting approximately $45 million of venture debt to be catalysed over the next year

CTO(Chief Technology Officer)-as-a-Service

This initiative aims to provide companies with access to professional IT consultancies, to help firms identify and adapt digital solutions more efficiently.

Digital Leaders Programme

Will be launched to help firms hire core teams to further develop their digital transformation roadmap.

Extensions of Existing Business-Focused Schemes

Enhanced support levels of up to 80%, from 70% previously for enterprise schemes, such as Scale-up SG, Productivity Solutions Grant, Market Readiness Assistance, and Enterprise Development Grant from end-September 2021 to end-March 2022.

Local Enterprises Funding Platform

An investment scheme targeted at large local enterprises was announced by Mr Heng. Under the scheme, the Government will set aside $500 million for a commercially managed funding platform with Temasek, which will match the investment. This means there will be S$1 billion in total for the fund manager to invest in non-control equity and mezzanine debt of large local enterprises.

Growth and Transformation Scheme for Built Environment Sector

This scheme is aimed to digitalise processes and upskill workers through the entire value of the Built Environment sector (includes construction, real estate and environment and facility services businesses). It will require developers to work closely with their consultants, contractors, and suppliers to level up as an ecosystem or value chain.

Further details about the scheme will be given by The Ministry of National Development during the debate on its budget.

Corporate Venture Launchpad (CVL)

The launchpad will provide co-funding for corporates to build new ventures through pre-qualified venture studios.

Open Innovation Platform (OIP)

Enhanced with new features such as a cloud-based Digital Bench for accelerated virtual prototyping and testing. Through OIP, problems faced by companies and public agencies can be matched with solution providers. The platform also co-funds prototyping and deployment.

Global Innovation alliance (GIA)

The GIA catalyses cross-border collaboration between Singapore and major innovation hubs across the globe. Its network has 15 city links, including four South-east Asian cities: Bangkok, Ho Chi Minh City, Jakarta and Manila. This will be expanded to more than 25 cities around the world over the next five years.

In addition, the Co-Innovation Programme will be included in GIA. The programme will support up to 70 per cent of qualifying costs for cross-border innovation and partnership projects.

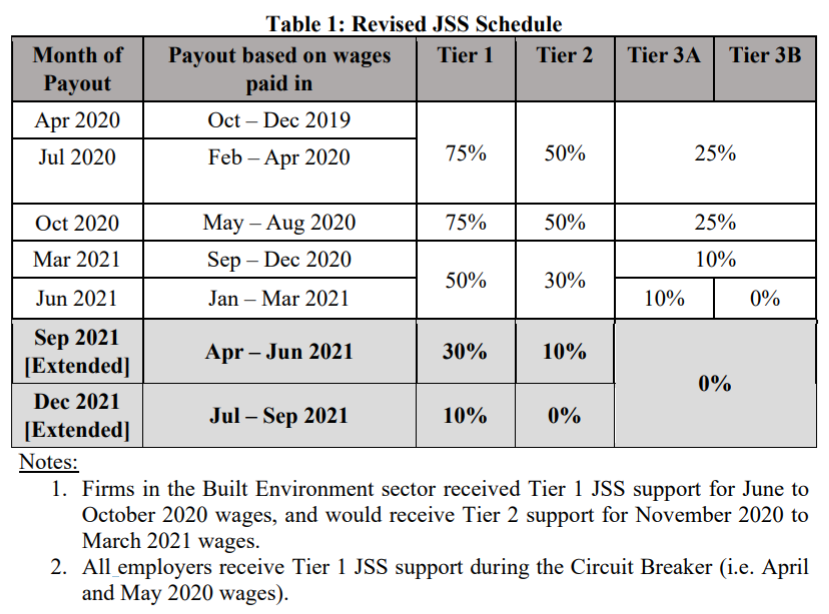

Jobs Support Scheme (JSS)

Extend support for Tier 1 sectors (Aviation, Aerospace, and Tourism)

- 30% for wages paid from Apr to Jun 2021, and 10% for wages paid from Jul to Sep 2021

Extend support for Tier 2 sectors (such as Retail, Arts & Culture, Food Services, and Built Environment)

- 10% for wages paid from Apr to Jun 2021

Covid-19 Recovery Grant

Continual support for workers who lost their jobs or experienced significant income loss.

- Up to $700 per month for 3 months for employees who have lost their jobs or are placed on involuntary no-pay leave for at least 3 consecutive months

- Up to $500 per month for 3 months for employees and self-employed persons who are facing average income loss of at least 50% for at least 3 consecutive months

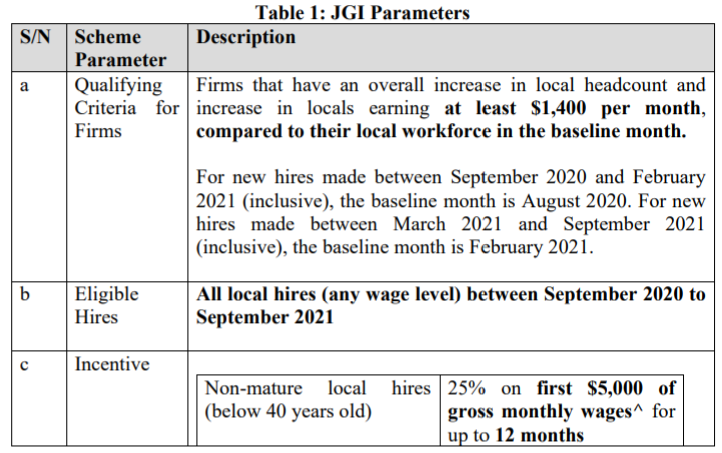

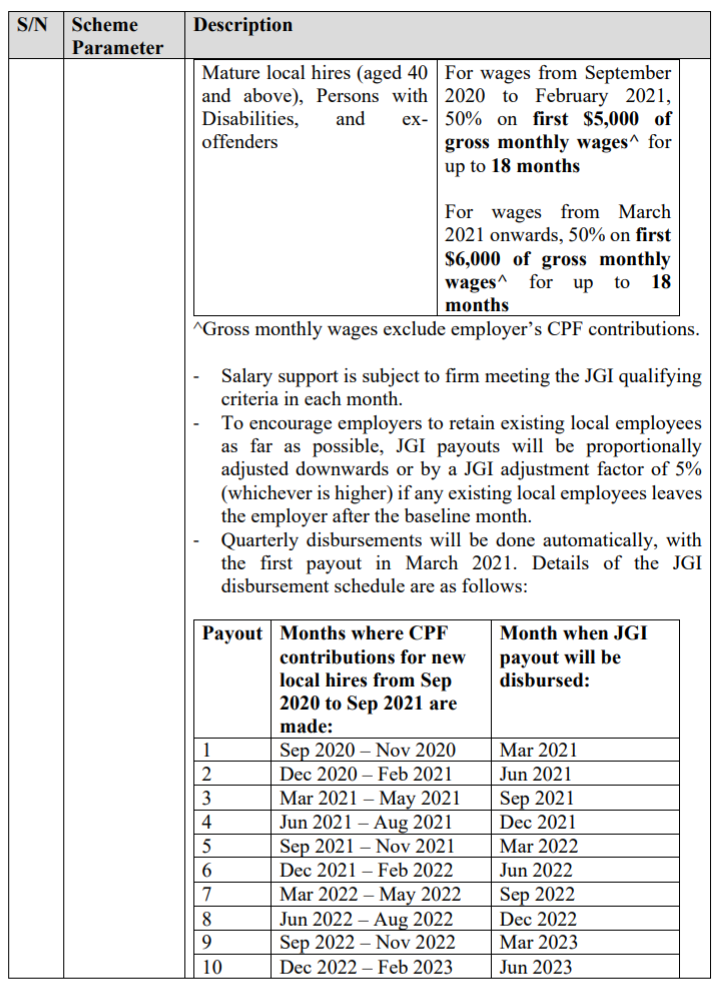

Jobs Growth Incentive (JGI)

The JGI supports employers to accelerate their hiring of local workers between September 2020 to September 2021 (inclusive), so as to create good, long-term jobs for locals.

SGUnited Traineeships

The SGUnited Traineeships (SGUT) programme provides recent graduates with opportunities to gain industry-relevant work experience and build professional networks, amidst weaker hiring sentiments during the COVID-19 pandemic. Workforce Singapore co-funds 80% of the qualifying training allowance for host companies offering traineeship opportunities targeted at recent graduates, with the remaining being funded by the employer.

SGUT will be extended for one year until 31 March 2022 to continue supporting fresh jobseekers from the 2021 graduating cohort, in addition to those who have graduated in 2020 and 2019, with the following adjustments:

- Starting from 1 April 2021, the stipend for ITE and diploma SGUT positions will be increased from $1,100 – $1,500 to $1,600 – $1,800 and from $1,300 – $1,800 to $1,700 – $2,100 respectively to encourage take-up. The stipend for university SGUT positions will remain unchanged.

- The maximum duration of each traineeship will be reduced from nine to six months from 1 April 2021 onwards, in line with the economic recovery and to encourage employers to offer trainees full-time jobs.

SGUnited Mid-Career Pathways Programme - Company Attachment (SGUP-CA)

The SGUP-CA programme is a full-time attachment programme with approved host organisations for mid-career individuals to gain industry-relevant experience, develop new skills and boost employability. Trainees currently receive a training allowance of up to $3,000 per month for the

duration of the programme. The Government funds 80% of the training allowance, while the host organisation funds the remaining.

SGUP-CA will be extended for one year until 31 March 2022 to continue supporting mid-career jobseekers with the following adjustments to encourage take-up:

- The maximum training allowance for mature trainees3 will be increased to up to $3,800 per month.

- The minimum training allowance for non-mature trainees will be increased to $1,600 per month.

- The Government co-funding rate for mature trainees will be increased to 90%.

- The maximum training duration of each company attachment will be reduced from nine to six months from 1 April 2021 onwards, in line with the economic recovery and to encourage employers to offer trainees full-time jobs.

SGUnited Mid-Career Pathways Programme - Company Training (SGUP-CT)

The SGUP-CT programme is a full-time training programme for mid-career individuals, developed and delivered by market-leading companies such as Google, Shopee, and IBM.

Trainees will receive a training allowance of $1,500 per month for the duration of the programme, to cover basic subsistence expenses. Individuals can use their SkillsFuture Credit to offset the course fees.

SGUP-CT will be extended for one year until 31 March 2022 to continue to support mid-career jobseekers in reskilling and upskilling, with the following adjustments:

- The capacity of in-demand courses and courses with good hiring opportunities will be expanded, to increase chances of jobseekers securing a job in growth sectors as the economy recovers.

- SGUP-CT courses will be made more compact from 1 April 2021 onwards, with a duration of up to six months in general, to channel jobseekers more quickly to employment opportunities.

SGUnited Skills (SGUS)

The SGUS programme is a full-time training programme comprising certifiable courses delivered by Continuing Education and Training (CET) Centres, including Institutes of Higher Learning. The training courses are designed in partnership with industry. Trainees will also have the chance to apply the skills learnt during the programme, through opportunities like workplace immersions and industry projects.

Trainees can also benefit from employment facilitation efforts offered by training providers. SGUS courses are conducted in a modular format to facilitate transition to employment as and when job opportunities are present.

Trainees will also receive a training allowance of $1,200 per month for the duration of the programme, to cover basic subsistence expenses. Individuals can use their SkillsFuture Credit to offset the course fees.

SGUS will be extended for one year until 31 March 2022 to continue supporting the reskilling of mid-career jobseekers with the following adjustments:

- The capacity of in-demand courses and courses with good hiring opportunities will be increased to help jobseekers access job opportunities in growth sectors as the economy recovers.

- SGUS courses will be made more compact from 1 April 2021 onwards, with a duration of up to six months in general, to channel jobseekers more quickly to employment opportunities.

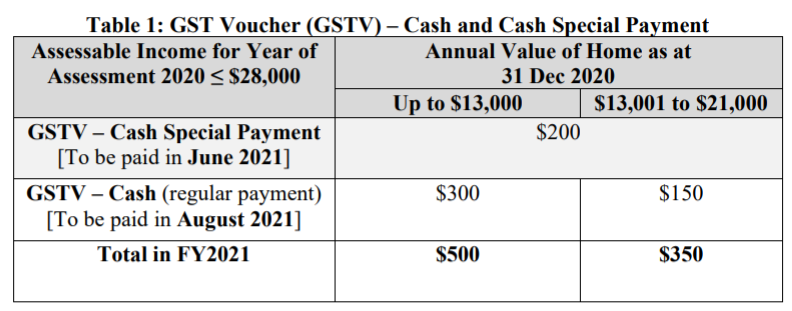

GST Voucher - Cash Special Payment

Lower-income Singaporeans who qualify for the GST Voucher (GSTV) – Cash (paid every August) will each receive an additional Cash Special Payment of $200 in June 2021. In total, lower-income Singaporeans can receive up to $500 in GSTV – Cash and Cash Special Payment this year, to help them with their daily living expenses. The GSTV – Cash scheme benefits Singaporeans aged 21 years and above in 2021 with:

(i) Assessable Income (AI) for the Year of Assessment (YA) 2020 of not more than $28,000,

(ii) Annual Value of place of residence (as reflected on NRIC) as at 31 December 2020 of not more than $21,000, and

(iii) ownership of not more than one property (see Table 1).

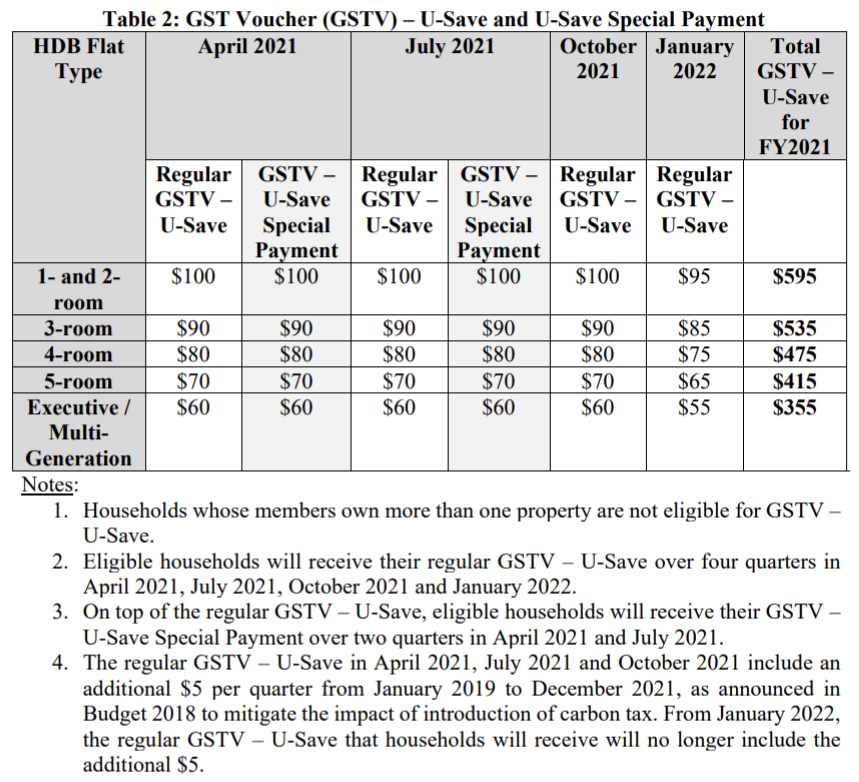

GST Voucher - U-Save Special Payment

All eligible HDB households will receive an additional 50% of their regular GST Voucher (GSTV) – U-Save this year, through a one-off GSTV – U-Save Special Payment (see Table 2). This U-Save Special Payment will be credited in April 2021 and July 2021, together with their regular U-Save.

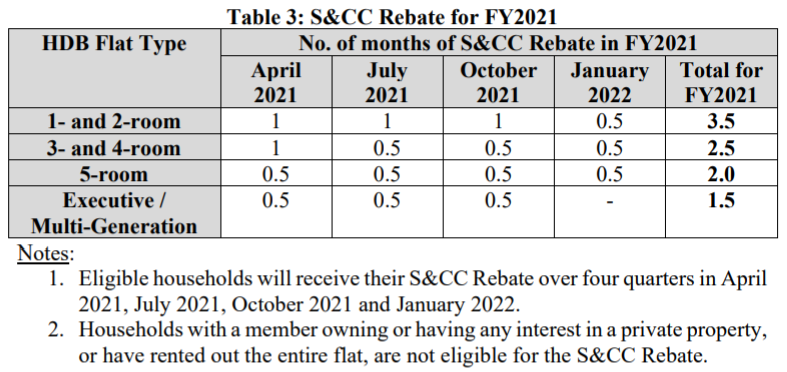

Service and Conservancy Charges Rebate

Eligible Singaporean households living in HDB flats will receive rebates to offset between 1.5 and 3.5 months of Service and Conservancy Charges (S&CC) over FY2021 (see Table 3).

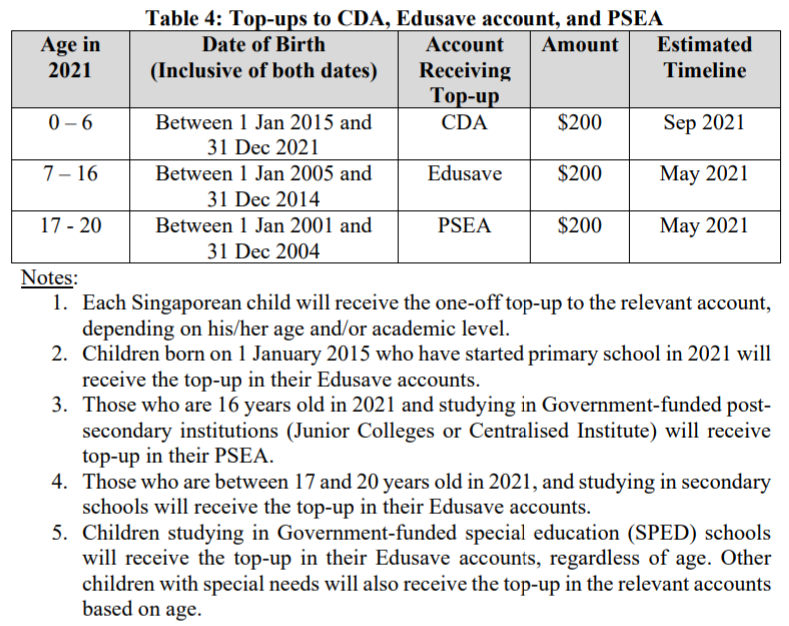

Top-ups to Child Development Account, Edusave Account, and Post-Secondary Education Account

The Government will provide families with additional support for their children’s education-related expenses. Each Singaporean child will receive a one-off top-up of $200 to the Child Development Account (CDA), Edusave account, or Post-Secondary Education Account (PSEA), depending on his/her age and/or academic level (see Table 4). The top-up to the Edusave account is in addition to the annual Edusave contribution that the Government makes.