The amount relating to the option money paid before 1 Jan 2023 is subject to the GST rate of 7%.

The remaining payment will be subject to the GST rate of 8% as the property is only made available on/ after 1 Jan 2023.

If you receive full payment for the banquet before 1 Jan 2023, you should only charge 7% GST to your customer even if the banquet is to be held on/ after 1 Jan 2023.

If you only receive a deposit before 1 Jan 2023 and will receive the balance on/ after 1 Jan 2023, the deposit is subject to 7% GST while the remaining payment is subject to 8% GST.

You should also make clear to your customer that the portion of the banquet price paid before 1 Jan 2023 is inclusive of 7% GST while the balance to be paid on/ after 1 Jan 2023 is inclusive of 8% GST.

The letter of claim is not a bill for payment (i.e. invoice) for GST purposes.

On the understanding that you would only issue the invoice to the developer upon the certification of the work done in 2023 and collect payment from the developer thereafter, the time of supply would be on/ after 1 Jan 2023. Hence, the supply of your construction services would be subject to 8% GST.

However, you can choose to charge GST at 7% as you have completed the construction works before 1 Jan 2023.

As you would only issue the invoice and collect the retention sum from the developer in Nov 2023, the time of supply would be on/ after 1 Jan 2023. Hence, the retention sum would be subject to 8% GST.

However, you can choose to charge GST at 7% on the retention sum as you have completed the construction works before 1 Jan 2023.

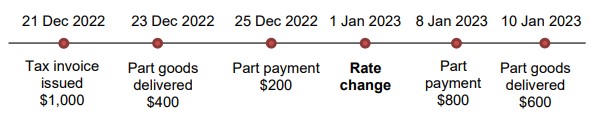

You are not allowed to reflect GST at 8% before the rate change effective date of 1 Jan 2023.

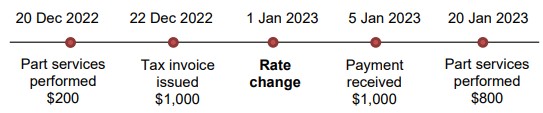

The advance invoice pertaining to the services from 1 Oct 2022 to 31 Mar 2023 should reflect GST at 7%.

If you do not receive full payment before 1 Jan 2023, you are required to issue a credit note for the lower of remaining payment or the remaining value of service to be performed on/ after 1 Jan 2023. Thereafter, you are required to issue a new tax invoice in respect of the amount credited out to charge GST at 8%.

Alternatively, you may issue a credit note to cancel out the original invoice and at the same time, reissue new tax invoice(s) for the value of supply subject to GST at 7% and value of supply subject to GST at 8% .

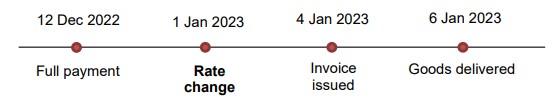

No. You are not allowed to issue a tax invoice with GST at 8% before the rate change effective date.

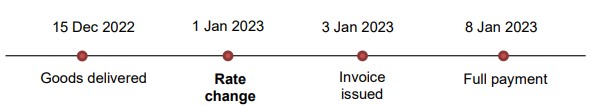

If you issue a tax invoice before 1 Jan 2023, you should reflect 7% GST on the tax invoice. If the payment is not received before 1 Jan 2023, you will need to issue credit note to cancel the original tax invoice and to issue a new tax invoice for the goods delivered after the rate change, showing 8% as the GST rate.

When you issue the tax invoice to your customer before 1 Jan 2023, you are advised to inform your customer on the potential GST adjustment under the rate change transitional rules to avoid dispute on the GST rate and GST amount payable on the supply.

You are not allowed to reflect GST at 8% before the rate change effective date of 1 Jan 2023. Hence, your invoice that is issued in Dec 2022 should reflect GST of 7% on the rental for the period 5 Dec 2022 to 4 Jan 2023.

Subsequently, assuming payment has not been received before 1 Jan 2023, you should issue a credit note by 15 Jan 2023 to cancel the portion of the rental for the period 1 Jan 2023 to 4 Jan 2023 billed at 7%, and to issue a new tax invoice at 8% for the same period.

The rental can be apportioned based on the number of days as follows:

Portion of rental that is subject to the GST of 7%

= Monthly rental x 27/ 31 days

Portion of rental that is subject to the GST of 8%

= Monthly rental x 4/ 31 days

When you issue the tax invoice to your customer before 1 Jan 2023, you are advised to inform your customers on the potential GST adjustment under the rate change transitional rules to avoid dispute on the GST rate and GST amount payable on the supply.

If you provide rebates to your customer that represent a discount for a past sale, you should calculate the GST on the rebate using the rate that is originally charged on the sale.

On the other hand, if the rebate is used to offset against the value of your next sale to your customer which takes place on or after 1 Jan 2023, you should charge GST at 8% on the net value of the sale.

For returned goods, you should adjust the GST using the rate that is originally charged on your supply of goods and maintain documentary evidence to show whether the goods returned were supplied before or on/after 1 Jan 2023.

Source: IRAS – FAQ