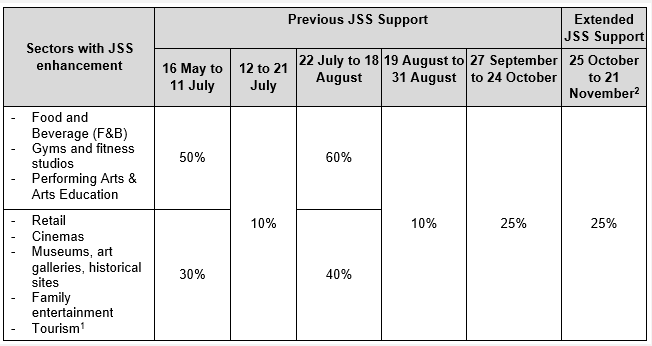

From 25 October to 21 November 2021 onwards, the Government will provide enhanced JSS support for the following sectors:

The enhanced payout corresponding to wages paid for Aug to Oct 2021 will be disbursed in December 2021. Employers who put local employees on mandatory no-pay leave (NPL) or retrench them will not be entitled to the enhanced JSS payouts for those employees.

If your company has an existing GIRO arrangement with IRAS or is registered for PayNow Corporate as at 24 Sep 2021, you will receive a payout titled “Jobs Support Scheme” (GIRO) or “GOVT” (PayNow Corporate) in your bank account from 30 Sep 2021. Other employers will receive their cheques from 15 Oct 2021 mailed to their registered business address.

As part of the checks for JSS eligibility, a small number of employers will receive letters from IRAS asking them to conduct a self-review of their CPF contributions and to provide declarations or documents to substantiate their eligibility for JSS payouts. Their Sep 2021 payout will be withheld pending the self-review and verifications by IRAS. The payout will only be disbursed after the completion of the review. If your company has been selected for self-review, please refer to Self-review for Eligibility of JSS and JGI for more information.