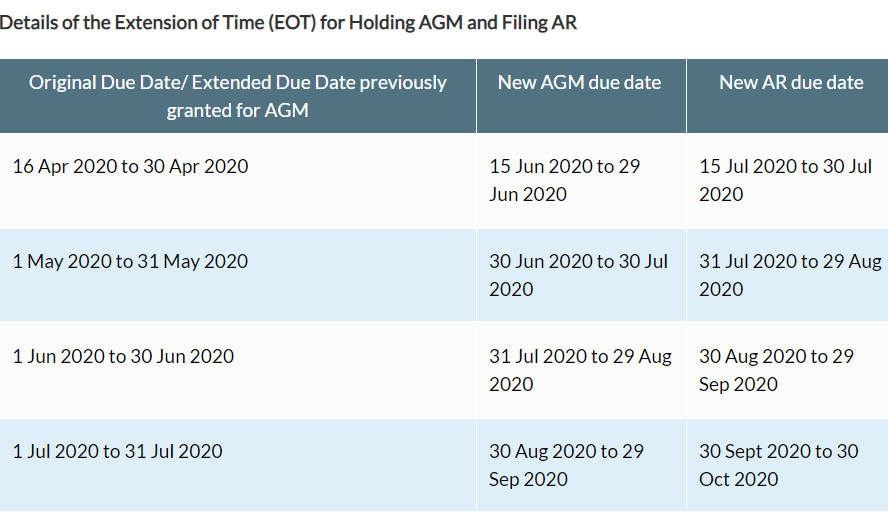

In light of the COVID-19 situation, some companies may have difficulties holding their Annual General Meetings (AGMs) and filing their Annual Returns (ARs).

For listed and non-listed companies whose AGMs are due during the period 16 April 2020 to 31 July 2020

ACRA will grant a 60-day extension of time for all listed and non-listed companies whose AGMs are due during the period 16 April 2020 to 31 July 2020.

Companies that had previously been granted extension of time to hold their AGMs within this period will also be given a further 60 days of extension from the last date of extension.

The AR filing due dates for the period 1 May 2020 to 31 August 2020 for all listed and non-listed companies will also be extended for 60 days. There is no need for these companies to apply for the extension of time with ACRA.

For listed and non-listed companies whose AGMs are due during the period 1 to 15 April 2020

ACRA will also not impose any penalties on listed and non-listed companies whose AGMs are due during the period 1 April to 15 April 2020 if they hold the AGM within 60 days of the due date. Their AR filing due dates will also be extended for 60 days. There is no need for these companies to apply for the extension of time.

Temporary Measures for Conduct of Meetings

ACRA and MAS are working with other relevant government agencies to propose legislative amendments to provide legal certainty in relation to the conduct of meetings, for companies implementing safe distancing measures. The proposed provisions are scheduled to be tabled in Parliament on or about 7 April 2020. Details of the approved provisions will be updated on this page when available.

In the interim, ACRA, MAS and SGX RegCo have issued a joint updated guidance to guide companies on the measures they could adopt in the holding of AGMs and general meetings amid the COVID-19 situation until the proposed legislative amendments have been passed in Parliament in April 2020.

Please click on the following links for more information: