Job Support Scheme ("JSS")

Current Treatment

The temporary enhancement to the JSS for the month of April 2020 will raise the wage support to 75% in that month. This will apply to the first S$4,600 of gross monthly wages paid to local workers (Singapore Citizens and Permanent Residents) in all sectors.

The first JSS payout (“Payout 1”) has been brought forward to April 2020.

For April 2020 payment, the government will give an Cash Grant of up to 75% of Oct 2019 wages. Subsequently, the Cash Grant in July 2020 will be adjusted downwards by 50% of Oct 2019 wages.

New Treatment

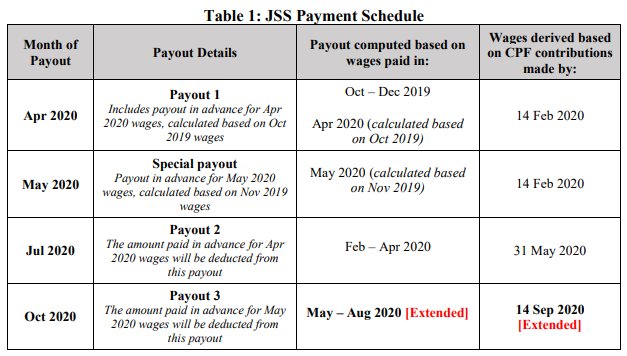

Extended for 1 more month to cover wages paid in August 2020, bringing a total coverage to 10 months of wages. The support for August 2020 wages will be paid out in October 2020 (see Table 1 for an overview of the JSS payment schedule).

- 25% to 75% of the first $4,600 of wages for each local employee

Only employers who are not allowed to resume operations will continue to receive 75% support for wages paid to local employees, during the period for which they are not allowed to resume operations, or until August 2020, whichever is earlier. Pro-ration will be applied if operations resume in the middle of the month.

Increased support for some affected sectors (e.g. aerospace, retail, marine and offshore) from 25% to 50% or 75%

SGUnited Jobs

Current Treatment

10,000 jobs will start with the public sector recruiting for long-term roles in essential services such as social services, early childhood education and infocomm technology.

Temporary jobs to handle the increase in Covid-19-related operations will also be available in roles such as health declaration assistants and temporary management support officers.

Private sector job opportunities will also be identified together with the Singapore Business Federation and other trade associations and chambers.

There will be a series of SGUnited Jobs Virtual Career Fair (VCFs) upcoming up.Details of the VCF is available here: mycareersfuture.sg

New Treatment

40,000 jobs aimed to be created in 2020 of which about 15,000 openings will be in the public sector. These consist of a variety of long-term and short-term roles, to meet future and immediate needs.

The public sector is bringing forward agencies’ hiring plans, creating jobs in new capabilities and functions, and creating short-term jobs arising from COVID-19 operations. The public sector will also provide two-year positions to local jobseekers and train them in key capability areas, to eventually place them in relevant private sector jobs.

The relevant Government agencies will work with businesses to create about 25,000 jobs. To help jobseekers continue to access good longer-term job opportunities, agencies will also work with programme partners to scale up the capacity of career conversion programmes, including the Adapt and Grow programmes, to more than 14,000 places this year, especially in growth sectors such as Infocomm & Technology and Financial Services.

SGUnited Traineeships and Mid-Career Traineeships

Current Treatment

Workforce Singapore (WSG) will co-share manpower costs with enterprises that offer up to 8,000 traineeships targeted at local first-time jobseekers this year.

Firms that offer traineeships targeted at local first-time job seekers this year can receive funding from government agency Workforce Singapore (WSG) under this SGUnited Traineeships programme.

These will include science and technology stints in research and development labs, deep-tech start-ups, accelerators and incubators, said DPM Heng.

Participants will receive an allowance co-funded by the Government and firm they are attached to.

New Treatment

Given the strong interest from businesses and public agencies, the Government aims to more than double the number of traineeships available for our young locals this year, from 8,000 to 21,000. Of these, there will be new traineeship positions in our R&D sector, including our universities, A*STAR research institutes, AI Singapore, and local deep-tech startups through SG Innovate. Recent and new graduates can apply for these opportunities on MyCareersFuture.sg from 1 June 2020 onwards.

To cater to the needs of mid-career individuals, we will create a new SGUnited Mid-Career Traineeships programme, to facilitate about 4,000 more traineeships for unemployed midcareer jobseekers looking to gain meaningful industry-relevant work experience and boost employability for future job opportunities. This will be on top of the 21,000 opportunities under the SGUnited Traineeships. More details will be provided in due course.

Overall, both programmes aim to facilitate about 25,000 traineeship opportunities for our young locals and experienced professionals.

SGUnited Skills

Current Treatment

Not applicable.

New Treatment

The SGUnited Skills (SGUS) programme is a full-time training programme ranging from 6 to 12 months. The programme will comprise certifiable courses delivered by companies and the Continuing Education Training (CET) Centres, including Institutes of Higher Learning. The training courses are designed in partnership with the industry, and can include companies co-delivering and co-designing the programme with training providers. Trainees will also have the chance to apply the skills learnt during the programme, through opportunities like workplace immersions and industry projects.

Trainees will also benefit from employment facilitation efforts offered by training providers. To facilitate transition to employment as and when job opportunities are present, the SGUS programme will be conducted in a modular format.

Trainees will also receive a training allowance of $1,200 per month for the duration of the programme, to cover basic subsistence expenses. Course fees will be highly subsidised, to keep SGUS affordable. Individuals can use their SkillsFuture Credit to offset the course fees.

More details on the SGUS programme will be provided by the Ministry of Education.

Hiring Incentive

Current Treatment

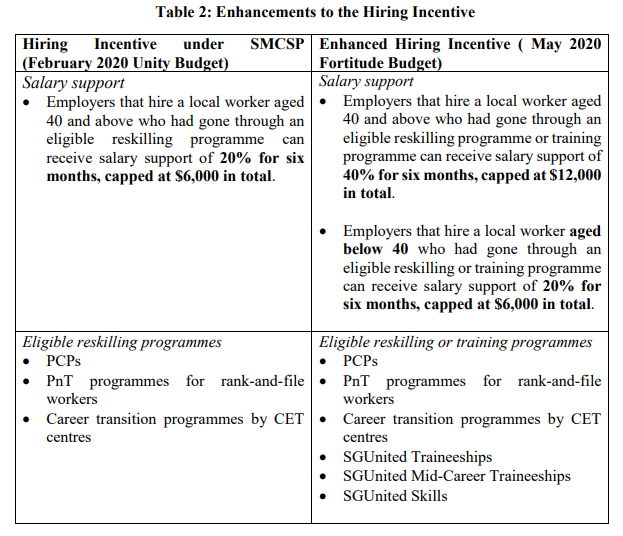

Employers who hire local workers aged 40 and above through eligible reskilling programmes. For each eligible worker hired, the employer would receive 20% salary support for six months, capped at $6,000 in total. Eligible reskilling programmes were the Professional Conversion Programmes (PCPs), Place-and-Train (PnT) programmes for rank-and-file workers, and career transition programmes by Continuing Education and Training (CET) centres.

New Treatment

the Hiring Incentive will be enhanced to cover local workers of all ages, with increased support for those aged 40 and above. We will also expand the list of eligible reskilling and training programmes. The enhanced Hiring Incentive will be applicable to any hire from eligible reskilling programmes from 27 May onwards. A summary of the enhancements to the Hiring Incentive is in Table 2.

Foreign Worker Levy Waiver & Rebate

Current Treatment

- Waiver of monthly Foreign Worker Levy (FWL) due in April 2020 to help firms with cash flow

- FWL rebate of $750 in April 2020 from levies paid this year, for each Work Permit or S Pass holder

New Treatment

Extended by up to 2 months for businesses that are not allowed to resume operations after the circuit breaker.

- 100% waiver and $750 rebate in June 2020

- 50% waiver and $375 rebate in July 2020

As at 27 June 2020, construction firms will also be eligible for Foreign Worker Levy rebates of $90 per month for each work permit holder, from August 2020 to December 2021.

Deferment of Higher CPF Contribution Rates

Current Treatment

Not applicable.

New Treatment

To help businesses manage costs in these challenging times, the Government will defer the planned increase in CPF contribution rates for senior workers by one year, from 1 January 2021 to 1 January 2022. The CPF Transition Offset scheme will similarly be deferred until after the higher contribution rates take effect.

Expanding Rental Relief for SMEs

Current Treatment

- 1-month rental waiver for office, industrial, and agriculture tenants of Government agencies.

- Laws to ensure property owners pass on Property Tax rebate to tenants.

New Treatment

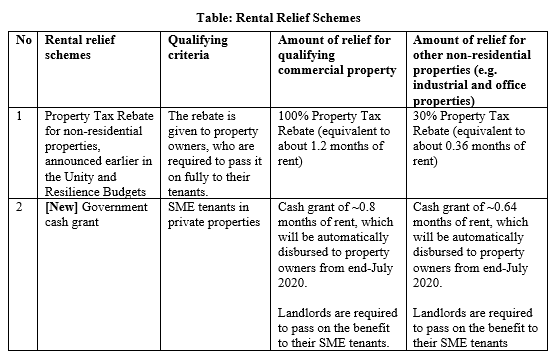

$2 billion in cash grants to help SME tenants with rental costs

Including the Property Tax Rebate for 2020, Government will:

- Offset 2 months’ rental for qualifying SME tenants of commercial properties

- Offset 1 month’s rental for qualifying SME tenants of industrial and office properties

Rental Relief for Government Tenants

Current Treatment

Stallholders at hawker centres and markets managed by the National Environment Agency (NEA) will be given three months’ worth of rental waiver, with a minimum waiver of $200.

Commercial tenants in other government-owned or managed facilities will be provided with two months’ worth of rental waivers.

Other Non-Residential Tenants. Government agencies such as JTC, SLA, HDB, URA, BCA, NParks, and PA will provide half a month’s worth of rental waiver to eligible tenants of other non-residential premises who do not pay Property Tax. Eligible tenants/lessees may include those in premises used for

industrial or agricultural purpose, or as an office, a business or science park, or a petrol station.

New Treatment

Additional 2 months of rental waivers for commercial tenants and hawkers. The total rental waiver will now be four months for commercial tenants. Stallholders in hawker centres and markets managed by Government

agencies will get a total of five months of rental waivers.

For industrial, office, and agricultural tenants of Government agencies, one more month of rental waiver will be provided. A total of two months of rental waiver will be received.

Financing Support for Promising Startups

Current Treatment

- Enterprise Financing Scheme – SME Working Capital Loan

- Enterprise Financing Scheme – Trade Loan

- Loan Insurance Scheme

- Temporary Bridging Loan Programme (TBLP)

New Treatment

$285 million of additional financing support for promising startups by co-investing with the private sector

- On top of $300 million set aside under the Unity Budget for deep-tech startups

Adopting e-Payments

Current Treatment

Not applicable.

New Treatment

Bonus of $300 per month over 5 months to encourage adoption of e-payments by stallholders in

- Hawker centres

- Wet markets

- Coffee shops

- Industrial canteens

Digital Resilience Bonus

Current Treatment

- E-invoicing Registration Grant

- Advanced Digital Solutions

- SMEs Go Digital

New Treatment

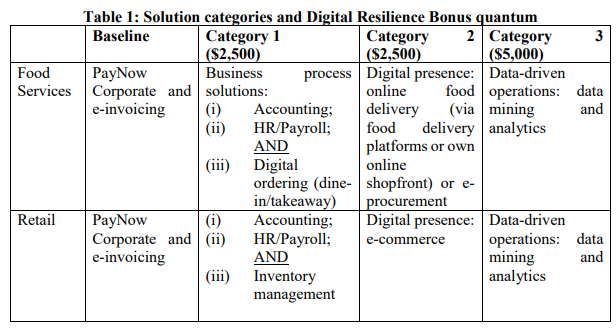

Eligible businesses can receive a payout of up to $5,000 if they adopt PayNow Corporate and e-invoicing, as well as business process or e-commerce solutions.

Businesses which already have basic digital capabilities, should deepen their digital transformation. We will help them make use of advanced digital tools in an integrated way.

- The Digital Resilience Bonus will have an additional tier of $5,000 for F&B and retail businesses which also incorporate advanced solutions.

National Innovation Challenges

Current Treatment

Not applicable.

New Treatment

Encourage partnership with the private sector for industry-led solutions to reopen Singapore safely

Covid-19 Support Grant (CSG)

Current Treatment

The scheme eligibility criteria are as follows:

- Singapore Citizens or Permanent Residents, aged 16 years and above,

- who are presently unemployed due to retrenchment or contract termination as a result of the economic impact of the COVID-19 situation, and meet all of the following:

- Had a monthly household income of not more than $10,000, or per capita household income not more than $3,100 per month prior to unemployment;

- Lives in a property with an annual value of not more than $21,000; and

- Not currently receiving ComCare Short-to-Medium Term Assistance(SMTA) or ComCare Interim Assistance.

- The applicant must have been employed as a full-time, or part-time permanent, or contract staff prior to unemployment.

Successful applicants will receive a monthly cash grant of S$800, for three months.

The scheme will be open for application from May 2020 to September 2020.

Individuals who are eligible may submit their application at their nearest Social Service Office,

New Treatment

Support for Singaporeans and PRs who:

- Have lost their jobs;

- Are placed on no-pay leave; or,

- Face significantly reduced salaries

Up to $800 per month for 3 months for eligible recipients

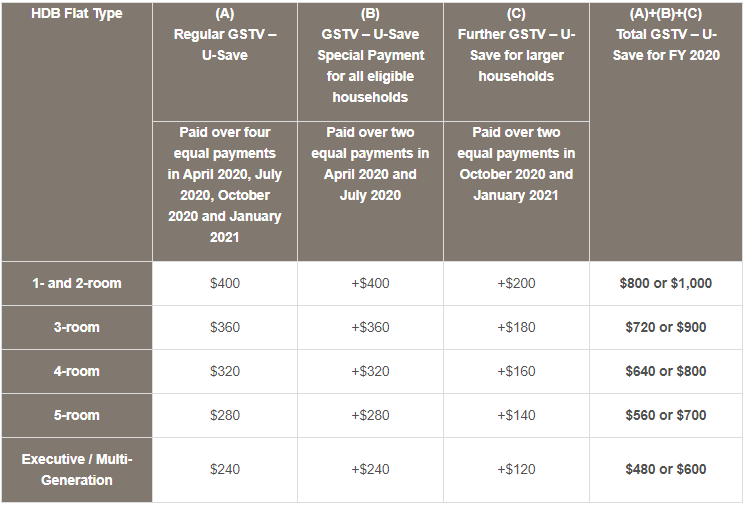

Solidarity Utilities Credit

Current Treatment

New Treatment

- One-off $100 Solidarity Utilities Credit for each household with at least one Singapore Citizen

- Covers all property types

- Will be credited in households’ July or August 2020 utilities bills with SP Group

- Larger households with five or more members get more, and can receive up to $1,000 in U-Save rebates this year

For Students and Seniors - Fostering Digital Inclusion

Current Treatment

Not applicable.

New Treatment

For Students

- Accelerated timeline for all secondary school students to own a digital learning device

For Seniors

- Seniors Go Digital movement to build digital literacy through one-to-one coaching and small-group learning

- Financial support for lower-income seniors to own digital devices

Enhanced Fund-Raising (EFR) Programme

Current Treatment

Totalisator Board (TB) provides 40% matching on donations raised by charities, capped at $100,000 per fund-raising project. For example, an eligible charity project which raises $10,000 will receive $4,000 in matching grants from TB. This applies to all modes of donations, including those through approved digital platforms such as Giving.sg or the websites of the individual charities.

New Treatment

- Dollar-for-dollar matching on eligible donations raised between 1 April 2020 to 31 March 2021, capped at $250,000 matching per charity

- Additional $100 million top-up to strengthen support for charities

Invictus Fund

Current Treatment

Not applicable.

New Treatment

The Invictus Fund was set up by the National Council of Social Service (NCSS) to channel donations to SSAs which deliver critical social services to vulnerable groups during COVID19. The Invictus Fund is supported by donations raised through Community Chest, which

receives 20% matching from the Bicentennial Community Fund.

As at 22 May 2020, $6.2 million has been raised for the Invictus Fund. 171 SSAs applied for the Invictus Fund in the first round of applications.

The Government will provide a top-up of $18 million to the Invictus Fund to enhance support for SSAs which continue serving their beneficiaries during this period.

Construction Support Package

Construction Restart Booster

A $525.8 million construction restart booster will be made available to help construction firms, which have to incur additional compliance costs unique to the sector in order to resume works safely. This funding will co-share contractors’ costs in procuring additional material/equipment to comply with COVID-Safe Worksite requirements (e.g. additional portable toilets, PPEs, masks, barricades). The funding will be given to construction projects regardless of whether they have restarted or are pending restart, as these compliance costs would eventually be incurred.

Co-funding salaries of Safe Management Officers (SMOs)

Contractors are required to deploy SMO(s) to ensure that safe management measures are implemented at construction worksites. Even though the SMO position can be taken up by an existing employee rather than as a new hire, Government will set aside $48 million to co-fund 50% of salaries of SMOs who are Singapore citizens or permanent residents for six months from September 2020 to February 2021, provided that the firms adhere to COVID-Safe Worksite practices.

Co-sharing of prolongation costs for public sector projects

Government Procurement Entities (GPEs) will co-share the prolongation costs for public sector construction contracts and tenders which closed before 1 June 2020. This will add up to $793 million. GPEs will co-share 50% of the prolongation cost, capped at 1.8% of contract sum. Main contractors for public sector construction projects may submit claims for the following prolongation cost for delays which are accompanied by certified Extensions of Time (EOTs) due to COVID-19:

a) Rental of plant and equipment by main contractors and the sub-contractors;

b) Other project-related costs such as vector control, insurance, etc.

In these challenging times, developers undertaking private sector projects should also likewise adopt similar practices to co-share prolongation costs with contractors for private sector projects.

Extension of Advance Payment for public sector projects

As some construction projects have not fully resumed work yet, the Government will extend advance payment to firms working on public sector projects. Main contractors of public sector projects were earlier granted advance payments for the months of April and May 2020. GPEs will now extend advance payment up to the point when the projects have obtained approval to restart, subject to a total advance payment cap of 5% of the project’s awarded contract sum or $10M, whichever is lower. Main contractors will be required to pass on a portion of the advance payment to their sub-contractors within two weeks of receiving the payment certificate from GPEs.

Extension of Government subsidies for COVID-19 tests

As part of BCA’s COVID-Safe Workforce criteria, employers should ensure that their employees undergo periodic swab tests to safeguard the health and safety of their employees as required. This includes all construction work permit holders and S Pass holders (except for those working in company office premises) and Singapore Citizens/ Permanent Residents/ Employment Pass holders working on construction sites. The Government had earlier announced that it would pay for the periodic swab test for construction work permit holders and S-pass holders, up to August 2020. The Government will now continue to bear the costs of COVID-19 testing for the construction sector until 31 March 2021, to help ensure a safe restart of the construction sector.